Ambani's new bet, Swiggy's earnings disappoint, and Apple Invites

🗓 Morning, folks!

The market is struggling for direction. Sensex turned around and slipped another 0.4% yesterday, with a similar move in the Nifty.

💡 Spotlight: Gold prices are on a tear. The 24K gold price hit an all-time high of ₹85,200 per 10 grams, while 22K gold climbed to ₹78,100.

Gold is often viewed as a safe haven to counter uncertainty by investors. Right now, it could be tariffs, Trump-risk, and inflation.

Let’s get through the headlines and leave you to better things.

1 Big Thing: Swiggy did not deliver 👎

Swiggy had its quarterly date with Mr. Market yesterday and it wasn’t all that cheerful. Revenues bounced solidly but losses widened too.

Quick look at numbers:

- Total order volumes of ₹12,165 crore, grew 38% YoY.

- Revenue of ₹3,993 crore, largely driven by core food delivery business, grew 31% YoY.

- Losses widened to ₹799 crore, up from ₹574 crore last year.

But with these delivery stocks, the story has now exclusively moved to Quick Commerce.

The company added 86 new Instamart dark stores in January, pushing further into quick commerce while also launching new services like Bolt and Snacc (10-minute food delivery), One BLCK (premium subscription), and Swiggy Scenes (restaurant event reservations) — essentially mirroring Zomato’s playbook.

Zoom out: FWIW, even Zomato saw profits tank last quarter, which suggests investments are ramping up with intensifying competition in quick commerce.

Bottomline: Swiggy thinks new offerings is the answer to growth. May be true, but competition is heating up, cash burn is nauseating, and public markets can get impatient fast.

2. Bengal gets the Ambani boost 🚀

Mukesh Ambani is doubling down on Bengal. Speaking at the Bengal Global Business Summit 2025, he committed ₹50,000 crore in fresh investments by 2030—matching what Reliance has already pumped into the state over the past decade.

The deets: the investment spans digital infra, retail, green energy, and heritage projects.

Jio will also upgrade a Kolkata data center into an AI-ready facility set to go live in nine months, while Bengal’s first cable landing station in Digha boosts digital connectivity.

The company is also expanding Reliance Retail, pushing its store count from 1,300 to 1,700 in three years while integrating local kiranas into its New Commerce network.

Big picture: regional investments are nothing new, but such comprehensive infrastructure commitments paint a picture of strong investor confidence, despite the public markets and macro data having you believe otherwise.

3. Big daily movers 🚀

JSW Energy surged over 5% after winning a 1,600 MW thermal power project from the West Bengal State Electricity Distribution Company (WBSEDCL).

The deal gives JSW the green light to develop and operate a greenfield thermal power plant using domestic coal. With this, the company’s locked-in generation capacity now stands at 30 GW, pushing it closer to its 20 GW target before 2030.

Despite the rally, JSW Energy’s latest earnings weren’t as electrifying—net profit fell 27% YoY to ₹168 crore in Q3FY25.

JSW Energy is part of the JSW Group, with a footprint across thermal, wind, hydro, and solar power.

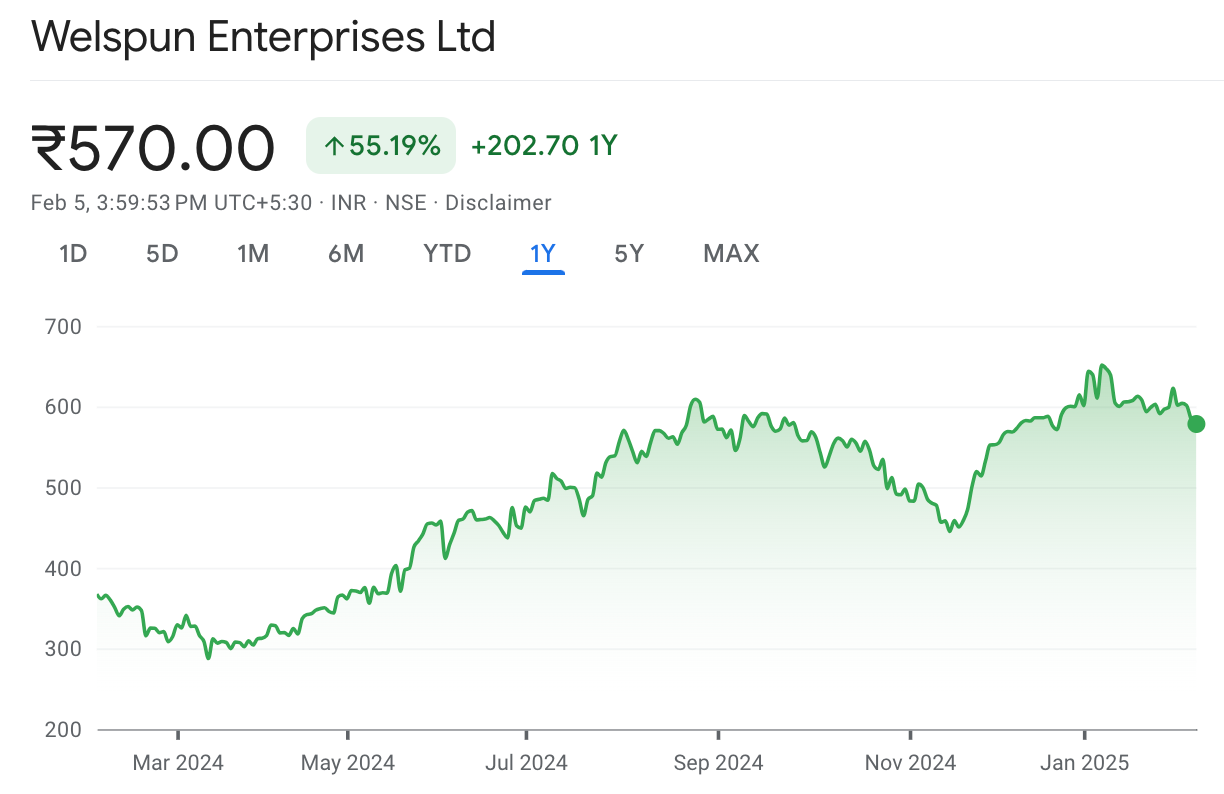

2. Welspun Michigan Engineers, a subsidiary of Welspun Enterprises, secured a ₹291 crore order from the BMC Mumbai to design and build the Mogra Storm Water Pumping Station in Mumbai.

This marks Welspun Michigan’s largest independent project in the pumping station segment, strengthening its urban infrastructure footprint.

Shares of Welspun Enterprises slipped 1.1% on the NSE, in line with a broader market dip. The stock, however, remains up over 50% in the last 12 months.

4. Quick IPO check ✅

IT consulting giant, Hexaware Technologies is set to launch its IPO, looking to raise up to ₹8,750 crore.

This will make it India’s biggest IT services and enterprise tech listing. The company plans to go public between February 12-14.

By the numbers: the company reported ₹5,684 crore in revenue for the six months ending June 2024, with the Americas contributing 73.3% of total revenue.

Hexaware has a global presence, with 31,000+ employees across 19+ countries and serves 370+ clients worldwide.

Quick nugget: one of the biggest IT services IPOs in India as of now, TCS’s 2002 listing, was ₹4,713 crore.

FYI: Hexaware was originally listed in 2002 before being delisted in 2020 by its former owner, Baring Private Equity Asia.

Carlyle acquired the company in 2021 for $3 billion and currently holds a 95% stake. The IPO is a pure offer for sale (OFS) by Carlyle.

What else are we snackin’ 🍿

🍔 APPetite: Zepto ranked second globally as the most downloaded app in the food & drinks category last year, right behind McDonald’s.

👥 Hiring: BlackRock is adding 1,200 jobs in Mumbai and Gurugram, increasing its headcount by a third.

✈️ Travel boom: Singapore saw a 21% jump in international visitor arrivals last year, with Indians among the top travelers.

📩 Apple Invites: Apple introduced "Invites," a new app for creating, sharing, and managing event invitations seamlessly.

🛑 Blocked: South Korea banned access to DeepSeek over security concerns, urging caution on AI use at work.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.