NTPC goes nuclear, Auto sales up, and AI in your pocket🗓 Morning, folks!

Markets snapped a 2-day losing streak with a sharp rebound on Wednesday. Sensex and Nifty jumped nearly 1% each, led by banking, IT, and realty stocks.

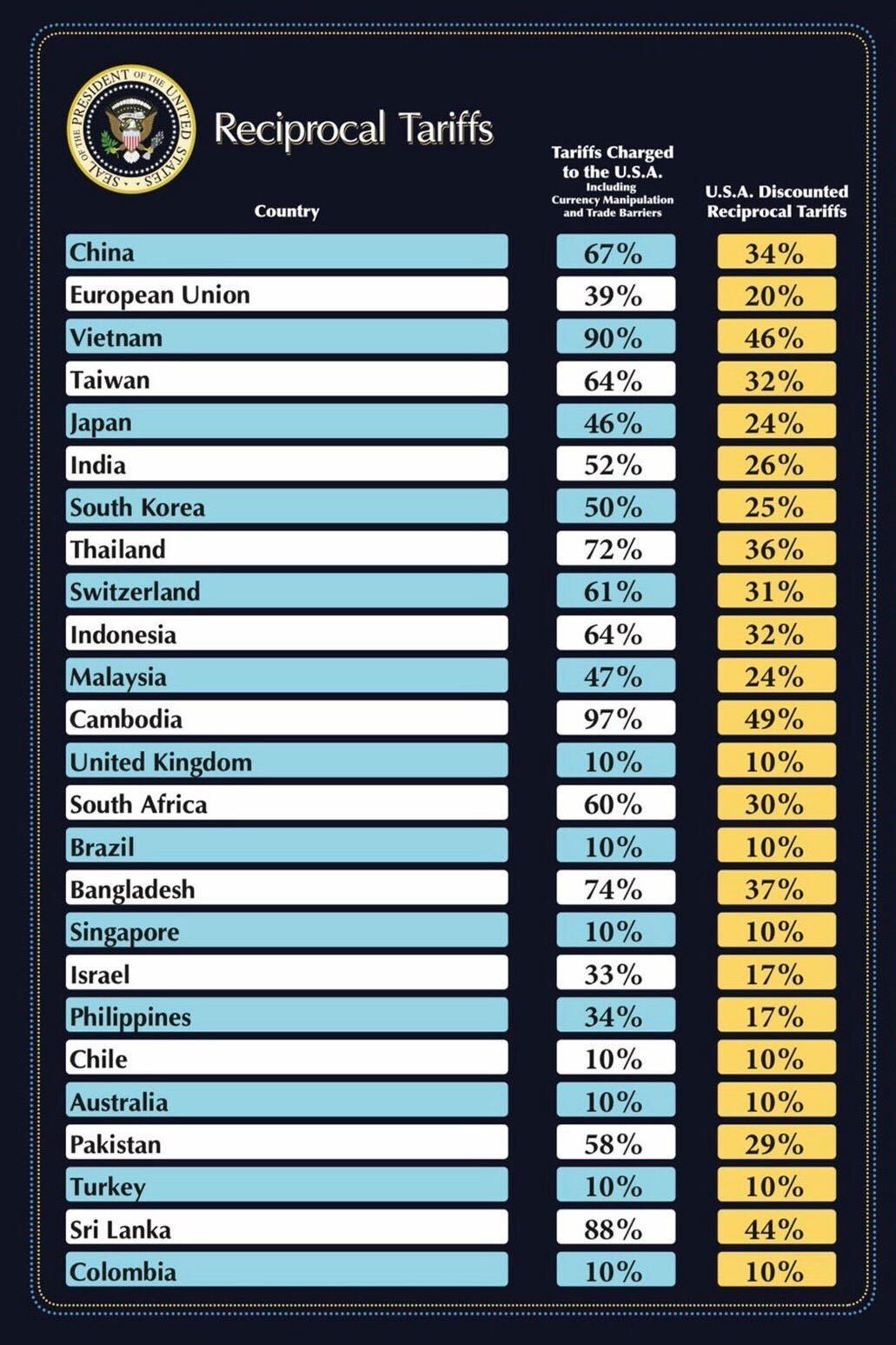

💡 Spotlight: Back in the west, Tariff man came out all guns blazing. On what he calls “Liberation Day" for America’s economy, Trump imposed sweeping tariffs on a range of countries, with a 10% minimum on all countries.

China and several smaller Asian countries took the worst. India was set at 26%.

Market’s response was sharply negative.

Let’s hit it!

1 Big Thing: NTPC eyes big bang nuclear bet ☢️

NTPC, India’s biggest power producer, is looking to team up with global players to build 15 GW worth of nuclear reactors. This marks the first major nuclear move since India began opening up its tightly controlled nuclear sector.

15 GW could power roughly 10 to 12 crore homes, that’s nearly half of India’s households.

Backstory: India’s 1962 Atomic Energy Act prohibits private firms from operating nuclear plants. But recent announcements suggest that law could be amended, opening the door to private and foreign capital.

The deets: NTPC is looking for partners that offer advanced pressurized water reactor technology and can commit to a lifetime supply of nuclear fuel.

Right now, nuclear power is still largely state-run. NPCIL (Nuclear Power Corporation of India Ltd) operates close to 8 GW and is aiming for 20 GW by 2032 and 100 GW by 2047.

The why: Nuclear energy can generate large-scale power without carbon emissions or air pollution, offering a stable, low-emission alternative to coal.

Worth noting: this comes right after the U.S. approved a major SMR (Small Modular Reactor) tech transfer to India, a big step in Indo-U.S. nuclear cooperation.

Big picture: India’s nuclear market is small but strategic. All 8 GW of current capacity is state-run, but with 10 new reactors under construction and policy reform in the pipeline, NTPC’s entry could be a turning point in making nuclear power a pillar of India’s energy future.

FYI, India now ranks 4th globally in installed renewable energy capacity—with 209 GW as of the latest numbers.

2. Reliance enters the esports biz 🎮

Reliance’s RISE Worldwide teamed up with Denmark-based BLAST Esports to launch a new gaming venture in India.

The deets: BLAST is a global esports powerhouse known for producing top-tier tournaments for games like Counter-Strike and Fortnite. The venture blends BLAST’s IP and production chops with Jio’s scale, tech, and reach, bringing international-grade esports to India via JioGames.

The why: with 450M+ Jio users and a fast-growing gaming platform, Reliance gives BLAST an instant stage in one of the world’s biggest gaming markets. For Reliance, it’s a chance to leapfrog into esports by tapping a seasoned partner rather than building from scratch.

Zoom out: Reliance already owns the IPL’s Mumbai Indians, now it’s betting that esports will be Gen Z’s cricket. The company has long played the infrastructure game in digital entertainment; this move signals it wants to own the content too.

Big picture: India has 600M+ gamers, nearly 18% of the global gaming population. The market is expected to more than double to $9.2 billion by 2029. Globally, esports is projected to hit $16.7 billion by 2033, growing at 22% a year.

While we are on deals,

MilkLane, a premium dairy supplier, signed a deal to supply 1 lakh litres of high-quality milk daily to South Indian dairy brand Milky Mist for the next three years. The deal is worth over ₹400 crore.

The deets: MilkLane supplies premium-quality milk and feed, with a focus on traceability, safety, and farmer support.

The why: the partnership aims to uplift over 10,000 farmers by providing fair milk prices and access to high-quality cattle feed. It also comes as Milky Mist gears up for a ₹2,000 crore IPO.

3. IndiQube gets SEBI nod for ₹850 cr IPO 🏢

IndiQube, a Bengaluru-based workspace solutions company, secured SEBI approval for its ₹850 crore IPO.

What they do: IndiQube offers managed office spaces to startups, SMEs, and large companies, handling everything from interiors to facilities. Think WeWork meets local scale.

The entire ₹850 crore will be raised through a fresh issue.

Why it matters: with post-COVID demand for hybrid and flexible workspaces on the rise, the company is betting big on scaling fast across new cities.

By the numbers: FY24 revenue jumped 43% YoY to ₹830 crore, but losses widened 72% to ₹341 crore as the company doubled down on growth.

4. Stock that kept us interested 🚀

1. GPT’s Infra’s bridge boost

GPT Infra shares rose over 7% after it won a ₹481 crore railway order from South Eastern Railway in Kolkata.

The deets: the project involves building a massive bridge over the Rupnarayan River. It also includes elevated platforms at Kolaghat Station as part of the Howrah–Kharagpur route revamp.

Why it matters: the company specialises in railway infrastructure and concrete sleepers and is already a major player with projects across India and Africa.

The order deepens its railway focus and strengthens its position in the high-value infra game, right as the country is ramping up transport connectivity.

5. Qualcomm wants AI in your pocket 📱

Qualcomm has acquired the generative AI division of VinAI, a top-tier AI research firm based in Hanoi, Vietnam.

The deets: VinAI specializes in computer vision, natural language processing, and generative AI. The acquisition signals Qualcomm’s push to build AI that works directly on devices, phones, cars, wearables, without needing the cloud.

How it works: VinAI has been developing compact generative AI models that don’t rely on giant cloud servers. These lightweight models are perfect for devices where constant internet access isn’t guaranteed, enabling smart features to run locally and seamlessly.

Why it matters: Qualcomm already builds Snapdragon chips with on-device AI engines. These chips are found in almost all android smartphone devices.

Background: this isn’t Qualcomm’s first AI move. It acquired voice-AI startup Aiqudo and chip design firm Nuvia for $1.4 billion, all part of a broader strategy to run AI directly on devices instead of depending on the cloud.

What else are we snackin’ 🍿

🚢 Port power: Adani Ports clocked its highest-ever monthly volume, handling 41.5 MMT in March, up 9% YoY.

🏭 Factory fire: India’s manufacturing PMI jumped to 58.1 in March, an 8-month high, as new orders surged.

📈 Deal heat: India’s Q1 2025 deal activity hit a 3-year high at $27.5 billion, up nearly 30% YoY, driven by strong domestic M&As and a surge in private equity moves.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.