Nuclear deals, Cyient's chip play, and Ola in trouble.

🗓 Morning, folks!

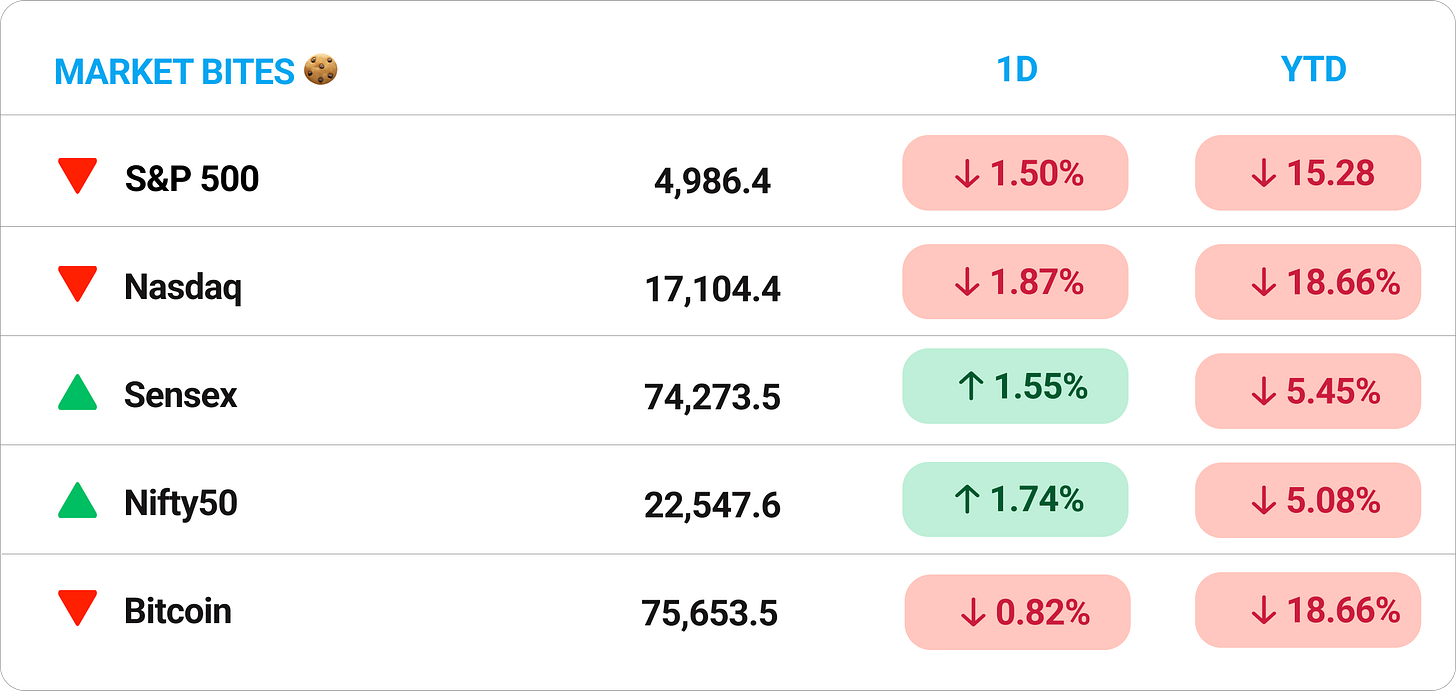

Markets bounced back on Tuesday, with both Sensex and Nifty rising over 1% after Monday’s steep drop in hopes that Trump may announce some positive trade deals.

📉 But the Don woke up for war. Trump imposed another 50% tariffs on China, taking the total tariff rate to a catastrophic 104%. The largest and the second largest economic powers, battling it out…. nothing is safe.

The S&P made a 5%+ move during the day, reversing course from a 3% odd high at one point to bottom out nearly 2%. They say it’s the largest intraday move in history.

Things are rough. Think twice before going all in lured by a false rally.

Let’s hit it.

1 Big Thing: boAt sails to its IPO 🎧

boAt has confidentially filed its papers for an IPO, joining the likes of Tata Play, OYO, Swiggy, and Credila Financial Services to take the secretive route.

Considering what’s going on in the market, the timing couldn’t have been worse.

Background: boAt has raised over $170 million to date, including a $60 million round in 2023 led by Warburg Pincus and Malabar Investments. Warburg remains the largest external stakeholder, followed by Fireside Ventures and Qualcomm.

By the numbers: revenue dipped 5% to ₹3,122 crore in FY24 from ₹3,285 crore in FY23. Losses, however, were slashed by 47% to ₹53.5 crore

Worth noting: this isn't boAt's first attempt to hit the street. The company had previously filed for a ₹2,000 crore IPO in 2022 but withdrew due to unfavorable market conditions. Instead, it settled for $60 million in private funding.

Zoom out: what could make the timing trickier is that India’s wearable tech market shrank 20.7% year-on-year in Q3 2024.

Despite that, average selling prices rose for the first time since 2019 signaling demand for slightly more premium picks.

2. Cyient’s $100M chip bet 🧠

Cyient, an India based tech and engineering solutions company, is investing $100 million to grow its custom semiconductor operations.

Why it matters: custom chips are becoming critical for sectors like EVs and smart grids that need efficient, specialized hardware. By investing in R&D and focusing on chip design, Cyient is tapping into a fast-growing, high-demand segment of the tech market.

It also strengthens India’s position in the global semiconductor space by building brainpower-driven, design-led solutions that are both cost-effective and scalable.

Background: Cyient has already delivered 40 custom chips to clients and now plans to double down by operating the chip unit as a separate, wholly owned subsidiary.

The company also hinted at a future IPO for the chip unit.

Zoom out: more local chip design means less reliance on imports—and more control over critical tech like EVs, smart meters, and telecom gear.

3. NTPC’s mini nuclear pitch ☢️

NTPC is exploring the use of Small Modular Reactors (SMRs) to replace its ageing coal-fired power plants.

SMRs produce zero carbon emissions—unlike coal—and offer a compact, efficient alternative for future energy needs.

The deets: NTPC has about 63 GW of coal power capacity, including its joint ventures.

The company has floated a tender to hire consultants and run feasibility checks for SMRs. Meanwhile, it is identifying coal plants that can be retired in the next 5 years and possibly replaced with SMRs.

Why it matters: India wants to cut coal use, meet rising energy demand, and go green. SMRs could be the sweet spot: compact, efficient, and climate-friendly.

Background: NTPC is already working on 15 GW of large nuclear capacity, including two 2.6 GW plants. It’s also in talks with foreign players—including Russia and the U.S.—for SMR partnerships.

This comes after India moved to amend nuclear liability laws to attract foreign and private capital into the sector.

Zoom out: India currently has ~8 GW of operational nuclear power, all run by state-owned NPCIL. The long-term goal? Hit 100 GW by 2047.

4. Ola’s never ending troubles 🛵

Ola Electric is under fire for inflating its February sales by counting bookings for vehicles that haven’t been delivered—or even launched. The move padded its market share at a time when it’s struggling to regain investor confidence.

Quite frankly, there isn’t a faster way to lose confidence with the investor community than such shenanigans.

The deets: Ola claimed 25,207 vehicle sales in February 2025. But nearly 12,000 of those were just bookings:

- 10,866 third-gen e-scooters (deliveries only began in March)

- 1,395 Roadster X motorcycles (yet to launch)

Government registration data told a different story: just 8,600 Ola vehicles were actually registered, about a third of the claimed figure.

The Ministry of Road Transport & Highways (MoRTH) has flagged the discrepancy and asked Ola to revise the data within 7 days “to avoid adverse action.”

Background: this isn’t Ola’s first regulatory run-in.

Last year, the company received a notice from the Central Consumer Protection Authority for misleading ads and unfair trade practices.

SEBI also pulled it up for announcing updates on social media before informing exchanges.

5. Stocks that kept us interested 📈

1. 🚁 India’s chopper game got a tech boost

Bharat Electronics bagged a major contract worth ₹2,210 crore from the Indian Air Force (IAF). The stock gained nearly 4% following the news.

The deets: BEL has secured the order to supply an advanced Electronic Warfare (EW) Suite for the Mi-17 V5 helicopters of the IAF.

In simple terms, an EW Suite is like a smart safety shield for helicopters. It helps the aircraft sense danger, such as enemy radars or missiles, and then automatically takes action to avoid or deflect the threat.

2. 🏗️ Mumbai gets a ₹1.5 lakh cr makeover plan

HUDCO signed an MoU with Mumbai Metropolitan Region Development Authority (MMRDA) to pump up to ₹1.5 lakh crore into Mumbai’s infrastructure over the next five years.

The deets: Housing and Urban Development Corporation (HUDCO) is a central public sector lender that funds housing, urban infrastructure, and social development projects across India.

With this MoU, the company will explore financing opportunities for MMRDA projects & offer consulting and capacity-building support to speed up execution.

6. Story in data: Beauty boom 💄

India’s beauty startup boom is being fueled by deeper cultural and economic shifts—rising incomes, evolving beauty ideals, and more women in the workforce.

Consumers are more open to self-expression and experimentation than ever, and homegrown brands are stepping up with inclusive, affordable, and digital-first products.

That momentum is paying off—beauty startups raised over $1.2B across 174 deals in 2024, a 90X jump in funding and 87X surge in deal flow since 2014.

As influencer-led D2C brands scale fast with premium positioning, India’s glow-up is turning into a serious business opportunity.

What else are we snackin’ 🍿

🐾 Pet pivot: Godrej launched a new pet care brand, Godrej Ninja, taking on rivals like Pedigree and Drools.

📦 Tariff takeoff: Apple flew five full planes of iPhones and other products from India and China to the U.S. in just three days to dodge incoming tariffs.

⚡ Energy race: India has overtaken Germany to become the 3rd-largest generator of wind and solar power, per a new report.

That’s a wrap! Don’t let the weekday blues get to you.

Markets are closed tomorrow for Shri Mahavir Jayanti, so we’ll be back like clockwork on Friday. 🤙

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.