🗓 Morning, folks!

Markets extended their losing streak to a seventh straight session, marking the longest slide in three months. Wall Street had a solid week, with the S&P 500 up 1.04% and the Nasdaq surging 1.43%, driven by Big Tech momentum.

💡 Spotlight: Chevron is setting up a $1 billion R&D center in India focused on advanced engineering and geotechnical analysis for global energy projects.

The facility, called ENGINE, will support carbon capture, gas production, and refinery tech, creating 600 new jobs

Anyway, easy news day today. Let’s get through it and leave you to better things. ☕

1 Big Thing: India’s tax code gets a rewrite ✍️

India’s income tax law is getting its biggest revamp in over six decades.

The Income Tax Bill 2025, tabled in Lok Sabha yesterday, aims to simplify, modernize, and declutter the tax system.

The deets: the bill trims the tax rulebook from 823 pages to 622, removes outdated provisions and cuts legal jargon. The term assessment year is gone—tax year (April–March) is in.

Why it matters: the Income Tax Act, 1961 had been amended so many times that it became a legal maze, fueling tax disputes and endless litigation. The new bill cleans that up, making compliance easier and reducing ambiguity.

Structural changes:

- CBDT gets more autonomy – the tax board can now tweak compliance rules and digital tax monitoring without waiting for Parliament.

- Explanations and provisos removed – no more confusing legal loops. The law is now easier to interpret.

- Tax rates & deductions tabled – everything from salary exemptions to TDS rates is neatly structured for clarity.

- Formula-based calculations – key computations (like Written Down Value) now follow standard formulas for consistency.

What’s unchanged: no changes to tax slabs—individual tax rates stay the same. But the bill reinforces the government’s “trust first, scrutinize later” approach, prioritizing self-compliance over aggressive scrutiny.

Zoom out: the bill is set to take effect from April 1, 2026. If passed, it would mark the most significant tax overhaul in India’s history.

Less paperwork, fewer disputes, and a smoother system? We’ll take it.

2. ITC doubles down on convenience 🍜

Mint reports, ITC is in talks to acquire pre-made breakfast foods giant, MTR Foods, for a whopping $1.4 billion.

MTR, a 100-year-old brand, is a household name in breakfast mixes, ready-to-eat meals, snacks, and beverages.

The context: ITC is pushing deeper into Southern markets, where MTR has a stronghold. The company’s food-innovation portfolio is also eyeing a pan-India expansion over the next 3–5 years, with Western India as its next target.

The bigger plan: ITC has been building out its food empire for a while now. It acquired Sunrise Foods in 2020 to boost its spices and ready-to-cook offerings. More recently, in Feb 2025, it snapped up Prasuma, a leading frozen and ready-to-cook food brand.

Despite the buzz, ITC’s stock closed nearly 1% lower today and has been under pressure this whole year.

While we are on deals, 🔋

ONGC and NTPC’s joint venture, ONGPL, has acquired a 100% stake in Ayana Renewable Power for ₹19,500 crore.

Ayana is one of India’s leading renewable energy companies, specialising in large-scale solar and wind power projects.

The bigger picture: India is on an aggressive clean energy push, aiming for 500 GW of renewable capacity by 2030.

This deal brings ONGC and NTPC closer to their own net-zero targets.

3. Deals that made noise 🚀

Bharat Forge signed two major aerospace deals at Aero India 2025.

- The company is teaming up with Liebherr-Aerospace to set up a Pune-based facility for landing gear components.

- Inked an MoU with VEDA Aeronautics to develop Unmanned Aerial Vehicles (UAVs) and high-speed aerial weapons.

FYI, Bharat Forge is traditionally an auto components giant but has been doubling down on defense and aerospace.

The move aligns with India’s Make in India push for defense manufacturing.

2. Indian Oil Corporation (IOC) inked a 14-year LNG supply deal with ADNOC Gas, securing 1.2 million tonnes per year.

ADNOC is the state-owned oil company of the United Arab Emirates (UAE).

IOC is India’s largest integrated energy company spanning across oil, gas, petrochemicals, and alternative energy sources.

India is pushing to increase natural gas usage to 15% of its energy mix by 2030. This is ADNOC’s second major LNG deal with an Indian company this week.

Why it matters: the deal supports India's goal of increasing natural gas to 15% of its energy mix by 2030.

Despite the massive contract, IOC’s stock remained largely flat on Tuesday.

4. Nazara misses the mark 🎯

Nazara, one of India’s only gaming pure-play stocks, reported strong growth but weak profits for its third quarter, flustering investors.

Revenue surged 67% YoY to ₹534.7 crore, but net profit dropped 53.6% to ₹13.7 crore as expenses piled up.

Driving the numbers: Nazara’s core gaming segment grew 53% YoY, fueled by acquisitions like Fusebox Games and solid performance from Animal Jam.

Nazara’s playbook lately has focused on buying gaming assets, plugging them into its distribution and monetising them further.

In this quarter, the company snapped up some more games including CATS: Crash Arena Turbo Stars and King of Thieves, which helped secure direct revenue streams.

Zoom out: India’s gaming industry is expected to hit $8.6 billion by 2027. Nazara has momentum, but cost pressures and shrinking margins show the market is getting competitive.

Despite the dip in profits, Nazara’s stock closed 1.3% higher.

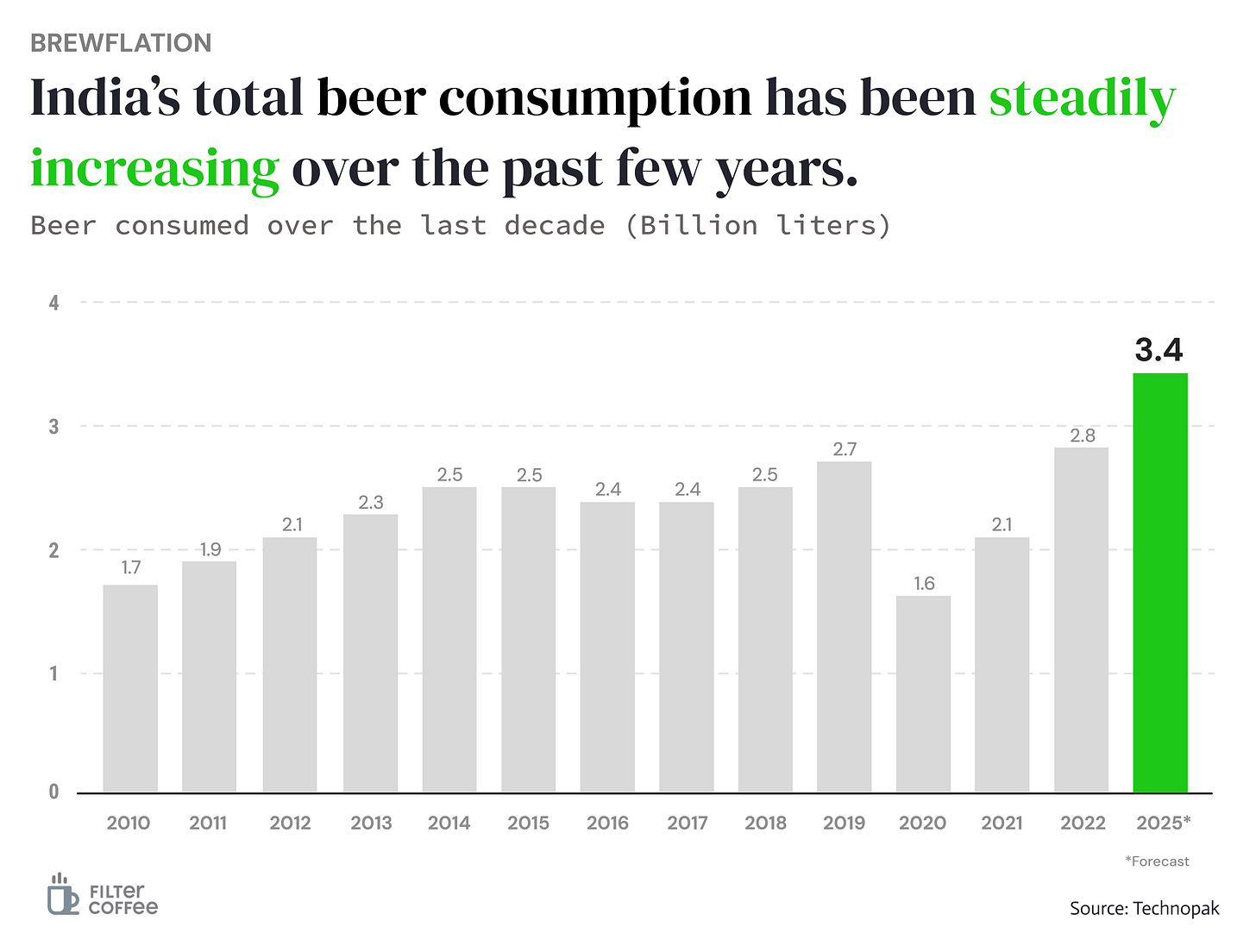

5. Chart of the day — Beer on the rise 📈

India is projected to consume 3.4 billion liters of beer in 2025, a new all time high.

Evolving tastes of a younger India are the the center of this trend. So is urbanization and generally a bit more disposable income as well.

What else are we snackin’ 🍿

⚡Fast charge: Tata.ev and Tata Power to install 500 fast-charging stations across metro cities.

🚀 Back in the game: Coinbase is in talks with the Indian government to resume operations after a year-long pause.

❌ Power cut: Adani Green exits $442 million Sri Lanka power project after cost negotiations on a $1 billion deal stalled.

🥤IPL refresh: Campa Cola replaces Thums Up as IPL 2025’s co-presenting sponsor in a ₹200 crore deal with Reliance.

🚗 No deal: Honda and Nissan call off merger talks, ending discussions on business integration.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.