Crypto fundings, Real estate IPO, and Intel's layoff.

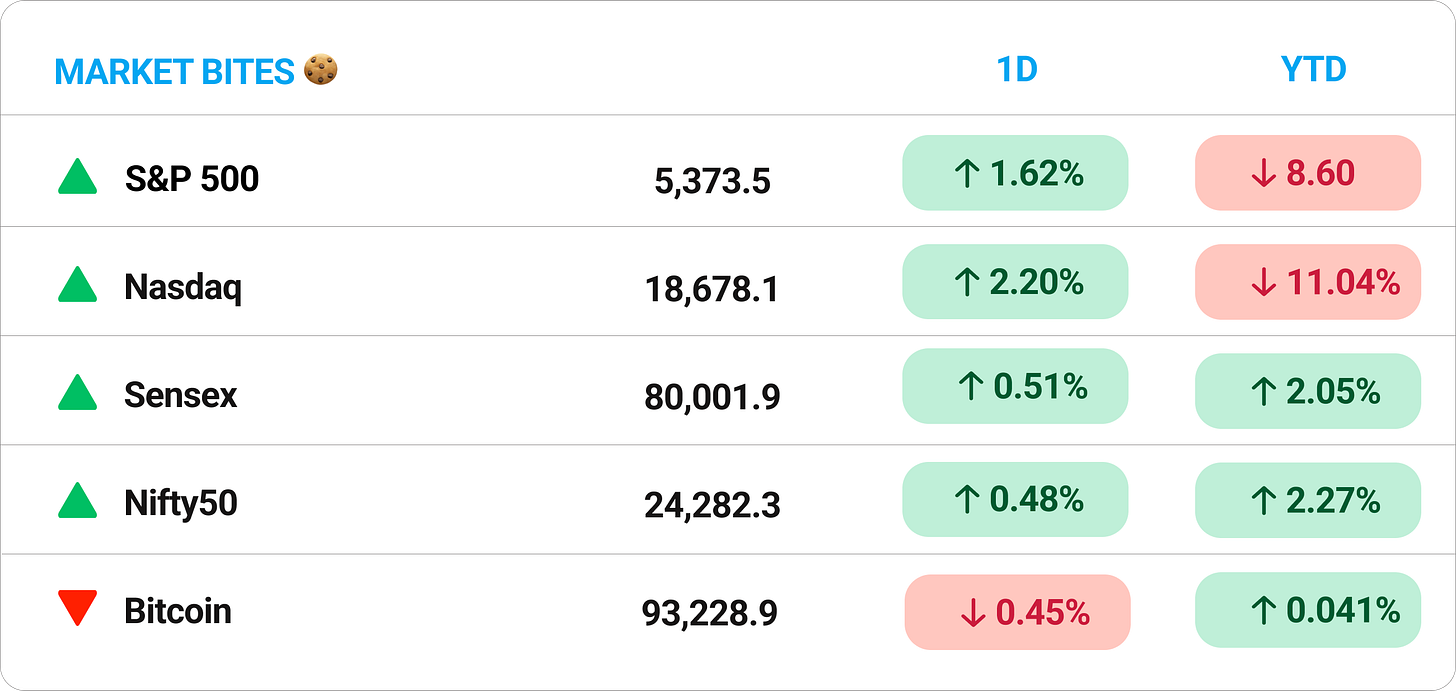

🗓 Morning, folks! Markets extended their winning streak to a 7th straight session on Wednesday. Sensex hit its highest level since December 2024 while Nifty reclaimed 24,200.

The rally was driven by strong IT earnings and solid gains in midcap stocks.

Spotlight: India’s private sector output jumped to an 8-month high in April, thanks to a strong rise in new business and a surge in foreign demand for manufactured goods.

Let’s hit it!

1 Big Thing: Waaree Energies reported a stellar Q4 ☀️

Shares of Waaree Energies jumped nearly 15% after the solar module maker posted a strong set of numbers for Q4 FY25, riding on scale, execution, and margin expansion.

By the numbers: net profit rose 34% YoY to ₹618.9 crore, while revenue from operations climbed 36% to ₹4,003.9 crore.

EBITDA more than doubled, rising 120.6% YoY to ₹922.6 crore, with margins expanding to 23%—up from 14.3% a year ago.

Production also surged, with Waaree manufacturing 2.06 GW of modules in the quarter, compared to 1.35 GW in Q4 FY24.

Waaree has also gone global. Its 1.6 GW facility in Texas, USA is now operational, strengthening its "local-for-local" strategy in a sensitive trade environment.

Zoom out: with a robust 25 GW order book worth ₹47,000 crore and an EBITDA outlook of ₹5,500–6,000 crore for FY26, Waaree is solidifying its position not just as a domestic solar leader—but as a serious global contender in clean energy manufacturing.

2. Accenture is acquiring TalentSprint 🎓

Accenture acquired deep-tech education firm TalentSprint from NSE Academy.

The deets: TalentSprint, is known for offering cutting-edge programmes in collaboration with top institutions like IITs, IIMs, and major tech companies.

Why this matters: there’s a massive skill gap in the workforce with rapid changes in AI, automation, and deep tech. By adding TalentSprint to its learning stack, alongside earlier investments in Udacity and Award Solutions, Accenture is building a one-stop solution to train the talent its clients need most.

While we’re on acquisitions…🚗

CARS24 acquired Team-BHP, one of India’s oldest and most respected community-led auto forums.

Launched in 2004, Team-BHP has been nurtured by millions of dedicated car owners, built on a shared passion for all things automotive. The platform carved a niche by offering unfiltered reviews, detailed ownership experiences, and razor-sharp insights—all without commercial influence.

CARS24 says Team-BHP will continue to operate independently after the acquisition.

3. Wadhwa eyes a ₹2,500 Cr IPO 🏢

Mumbai-based real estate player Wadhwa Group is planning to raise ₹2,000–2,500 crore through an IPO, with a DRHP filing expected in the coming month.

The deets: Wadhwa Group is known for its premium residential, commercial, and township projects, with over 10 million sqft already delivered. Its commercial portfolio includes marquee properties like The Capital, Platina, and Trade Centre in BKC.

The IPO proceeds will be used to reduce debt and fund new developments. ICICI Securities, JM Financial, and DAM Capital are advising on the proposed offering.

Big theme: with stock markets holding strong and real estate demand steady, developers are turning to public markets to deleverage and grow. And Mumbai-based developers are clearly leading the way.

Mumbai’s realty IPO wave:

- Lodha Group (Macrotech): ₹2,500 crore in 2021

- Rustomjee (Keystone): ₹635 crore in Nov 2022

- Arkade Developers: ₹410 crore in Sept 2024

- Suraj Estate Developers: ₹400 crore in Dec 2023

- Runwal Enterprises: Filed for ₹1,000 crore IPOShare

4. Stocks that kept us interested 🚀

1. Suzlon’s wind just got wilder 💨

Suzlon Energy bagged a 378 MW wind energy project from NTPC Green Energy, taking their total partnership to 1,544 MW. This marks Suzlon’s second-largest order from NTPC to date.

The deets: Suzlon will install 120 giant wind turbines, each as tall as a 40-storey building, and each capable of generating 3.15 MW of electricity. They’ll handle everything, from building the foundations to setting up the turbines and keeping them running smoothly afterward.

This is Suzlon’s second big win in a week, it also snagged a 100.8 MW project from Sunsure Energy just days earlier.

2. Sona BLW sparks up on Tesla boost 🚗

Sona BLW jumped 6% on Wednesday after Tesla, one of its key clients, shared an upbeat outlook on the production of its Model Y.

Sona BLW supplies important parts like motors and drivetrain components to Tesla for its electric vehicles, including the Model Y.

The deets: during its post-earnings call, Tesla confirmed that Model Y production has bounced back to earlier levels, sparking investor optimism for auto component suppliers like Sona BLW.

Background: during the December quarter, Tesla’s production of these two models had dropped 16% YoY. This weighed on suppliers like Sona BLW. But now, with volumes normalising, these headwinds are expected to ease.

5. Story in data: Crypto freeze 📊

Crypto just hit a milestone—becoming the fifth-largest asset class in the world. But behind the headlines, VC funding tells a quieter story.

Deal activity has nearly halved since FY22, and total funding remains a third of peak levels. Investors are wary, burned by past hype cycles, collapses, and unclear regulation.

Big ideas still get backing, but the froth is gone.

What else are we snackin’ 🍿

⚡ IPO cutback: EV maker Ather Energy has cut its IPO size to ₹2,626 crore from the earlier planned ₹3,100 crore.

🛢️ Refinery duo: India and Saudi Arabia have agreed to set up two oil refineries in India through a joint venture, strengthening energy ties between the two nations.

🤝 Tariff u-turn: President Trump says he’ll be “very nice” to China in trade talks, hinting at a possible tariff rollback if a deal is reached.

🏍️ Tariff throttle: India may scrap import duties on high-end bikes to help clinch a trade deal with Trump, a move that could benefit Harley-Davidson.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.