L&T's largest deal ever, A dairy fundraise, and Index shuffle.

Shar☀️ Good morning, the weekend is almost here!

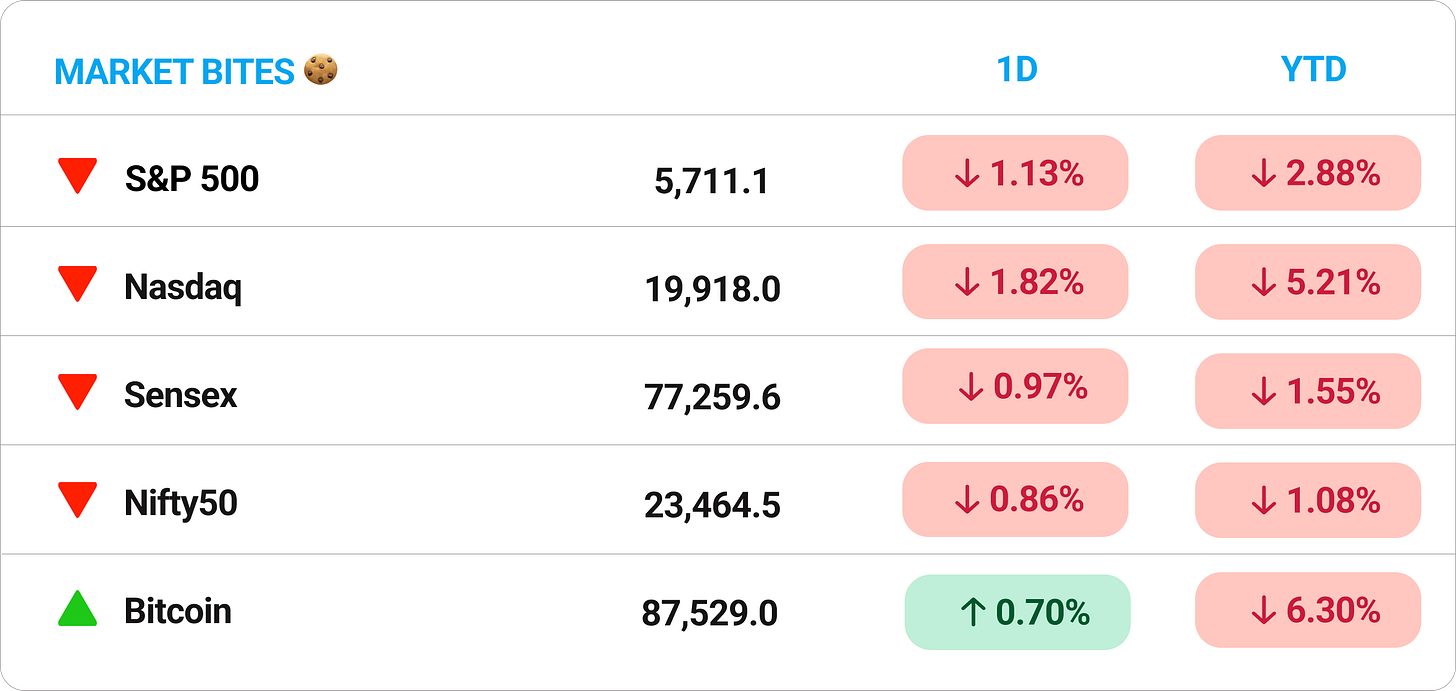

Markets finally hit the brakes after a solid seven-day run. Both Sensex and Nifty dropped nearly 1% as investors booked profits.

40 of the Nifty 50 stocks ended lower, and sectors like energy and realty bore the brunt.

💡 Spotlight: Midcap stocks are quietly stealing the show, again. The Nifty Midcap 100 is on track to outperform the Nifty 50 for the fifth straight year.

In FY25 so far, it’s up 8.1%. In comparison, the Nifty 50 is down ~10% and smallcaps ~18% from their highs.

Anyway, easy news day today. Let’s get through it and leave you to better things. ☕

1 Big Thing: Country Delight snags $25M from Temasek 💰

Country Delight, a dairy and daily essentials brand, is raising $25 million in its Series E funding round from Temasek.

The deets: Country Delight is an Indian D2C brand that delivers fresh, natural dairy products and daily essentials directly to customers' doorsteps. Their offerings include milk, ghee, paneer, yogurt, bread, eggs, fruits, and vegetables.

Country Delight recently ventured into the quick commerce segment too, launching a pilot for 10-15 minute deliveries in Gurugram.

By the numbers, in FY24, the company reported a revenue of ₹1,380 crore, a 50% increase from ₹917 crore in FY23.

Bottomline: as disposable incomes rise and health-conscious urban consumers become pickier about what goes on their plate, there’s a clear shift toward premium, farm-fresh options.

And in a world of watered-down milk and mass-market eggs, there is plenty of room for a trustworthy disruptor to thrive.

While we are on fundraises,

Groww is in talks to raise $200 million ahead of its IPO.

The deets: Singapore’s GIC and existing investor Tiger Global are participating in the funding round.

This investment could value the startup at approximately $6.5 billion. The company has already raised close to $400 million so far.

2. L&T seals its biggest ever deal 📈

Larsen & Toubro (L&T) bagged its biggest offshore hydrocarbon deal ever, a ₹15,000+ crore order from QatarEnergy LNG.

The deets: L&T is one of India’s top engineering and construction giants. It builds everything from metros and airports to power plants and oil rigs.

The company will build offshore platforms for extracting natural gas from the sea. It will also set up supporting infrastructure to aid QatarEnergy’s LNG operations.

Why it matters: this deal is a major vote of confidence to India’s engineering services prowess, which is critical as we seek to expand influence in the region to counter similar ambitions displayed by Chinese giants.

While we are on deals,

Bharat Dynamics bagged a ₹4,362 crore order from the Defence Ministry to supply weapons and equipment to the Indian Armed Forces.

The deal is part of the Defence Acquisition Council’s (DAC) ₹54,000 crore procurement push. The stock ended 1% higher in a weak market.

3. Tech titans unite for AI 👊

Cognizant is partnering with Nvidia to help old school companies put AI to real use—in customer service, healthcare, manufacturing, and more.

What’s happening: the two companies are building a low-code framework using Nvidia’s NIM microservices to let businesses create multi-agent AI systems.

Think sales bots, marketing agents, and supply chain assistants that work together, talk to each other, and keep getting smarter—automating grunt work and decision making.

- In healthcare, Cognizant is rolling out a custom language model that helps insurers handle claims faster and more accurately.

- In manufacturing, they’re using Nvidia’s Omniverse platform to create digital twins of factories—basically virtual versions that help companies test layouts and optimize workflows.

- And on infrastructure, they’ll offer Nvidia’s AI tech in cloud, data center, and edge environments to help clients speed up their AI deployment.

Big picture: AI adoption is still tricky for many businesses. With companies struggling to move AI from the lab to the frontlines, this partnership could bridge that gap.

4. Story in data: Retail investors wont back down 📊

SIPs have gone from a niche tool to a mainstream financial habit, key to wealth building for India’s ambitious class.

The steady climb reflects rising financial awareness and investor confidence in markets.

What was once a niche tool is now a mainstream habit, driven by rising financial awareness, easier access, and a growing belief in long-term investing.

What else are we snackin’ 🍿

📈 Index shuffle: Zomato and Jio Financial join the Nifty 50 today. Expect fresh inflows.

🚗 Expansion: Maruti will invest ₹7,410 crore for a third manufacturing plant in Kharkhoda, Haryana, to produce up to 2,50,000 vehicles annually.

🛢️ Import impasse: Reliance paused Venezuelan crude purchases after U.S. slaps 25% tariff.

📅 Mark your calendars: RBI's rate-setting squad will meet six times in FY26, kicking off with the first huddle on April 7–9, 2025.

🚨 UPI outage: A technical glitch disrupted transactions across Paytm, Google Pay, and PhonePe yesterday.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.