Airtel's earnings, Mega deals, and A gold rush.

🗓 Morning and Happy Friday!

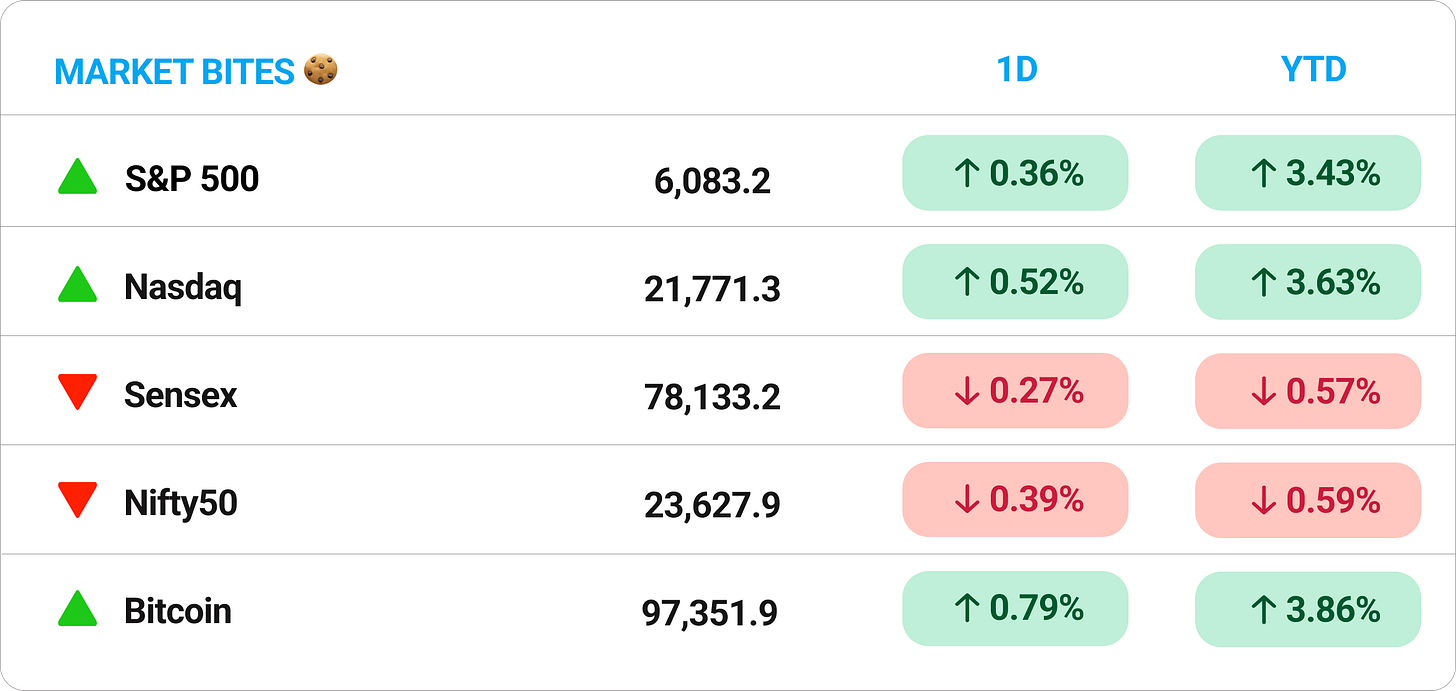

No luck in the markets so far this year, with the Sensex crawling back another 0.27% yesterday and the Nifty down 0.39%.

All eyes will be on RBI’s rate cut today, with expectations lined up for a 0.25% cut — the first in over five years. The economy needs it.

💡 Spotlight: meanwhile, enthusiasm in the private markets is peaking. January saw venture funding hit $1.75 billion, the highest it has been in six months. Growth-stage startups took the lion’s share, but early-stage deals weren’t far behind.

The industry also saw M&A accelerate, with some 128 deals closed. The most notable ones included HUL buying Minimalist and Everstone snapping up SaaS firm Wingify.

Let’s hit it.

1 Big Thing: Zomato’s transformation to an ‘Eternal’ business 🛵

Zomato has had a remarkable run in recent months, from a stock rally that doubled its value in 2024 to ultimately securing a spot in the Sensex to cap off 2024.

And now, the company is taking a bold new step, rebranding itself as a holding entity under the name Eternal Ltd.

The deets: the Zomato app stays the same, but the holding company gets a new identity. The website moves to Eternal.com, and the stock ticker will switch from ZOMATO to ETERNAL once regulators sign off.

Under Eternal, the company will house four segments — Zomato (food delivery), Blinkit (quick commerce), District (restaurant experiences), and Hyperpure (B2B supplies).

- Such transitions are not uncommon. When Facebook’s businesses started growing beyond the old-blue app, they structured as Meta Platforms. Google became Alphabet. There are countless other examples.

At the end of the day, such moves are designed to create organizational efficiency, and a cleaner and simpler story, for both investors and employees.

Zoom out: Zomato’s revenue for the December quarter had jumped 64% YoY to ₹5,405 crore, with Blinkit contributing ₹1,399 crore, clearly showing that food delivery is no longer the whole story.

Market’s didn’t care much for the change. Zomato’s stock closed 0.95% lower after the news.

2. India’s Teleco’s are dialing up the game 📶

Not that long ago, investors had an aversion towards Indian telecom companies, as Jio rocked the industry with brutal price-cuts and share wars, amidst an expensive 4G investment cycle.

But now consumers are hooked to digital services, and the freebies are gradually replaced by price hikes, and the telcos are reaping profits.

Airtel delivered a monster quarter yesterday, with acceleration across its core business, thanks to rising mobile tariffs and strong demand for data services from India’s digital-class.

Major stats: the company posted a robust 505% jump in net profit to ₹14,781 crore, with revenue climbing 19% YoY to ₹45,599 crore — not the kind of growth you see from telcos everyday.

Large chunk of the revenue was driven by impact of recent mobile tariff growth through 2024. Mobile services revenue specifically grew 21.4% YoY.

Zoom out: well capitalized and competitive telcos are the backbone of our digital infrastructure. But the real question is, how long can they keep raising prices before consumers universally start to revolt? Investors aren’t so sure.

Until then, what an amazing backdrop for that looming Jio IPO!

3. Major deals in focus 🚀

1. Lotte Wellfood is going all in on India. The South Korean parent of Havmor Ice Cream opened one of its largest ice cream manufacturing facilities in Pune, with a production capacity of 50 million liters.

The deets: Lotte has invested ₹500 crore into the Pune plant and plans to pump $300 million more into capacity expansion and supply chain upgrades over the next few years.

The company is also bringing its best-selling Korean snack, Peppero, to India in July, produced locally in Haryana.

Big picture: India’s $3 billion ice cream market is still a fraction of China’s $23 billion industry. As the Indian consumer base expands, Lotte sees huge potential.

2. Amazon signed a 100 MW power purchase agreement (PPA) with CleanMax to power its operations with wind energy. Clean max is one of Asia’s leading renewable energy firms.

The deets: CleanMax will develop and operate a wind farm in Karnataka, set to go live by Q2 2026.

The project will generate 355 million kWh of clean electricity annually, offsetting 252,000 tonnes of CO₂, the equivalent of planting 14.8 million trees per year.

CleanMax, which operates 2 GW of renewable assets across India, the Middle East, and Southeast Asia.

4. Quick walk down venture lane 💰

Entrackr reports TrueFoundry, the AI deployment startup, has raised $19 million in Series A funding, led by Intel Capital, with backing from Peak XV’s Surge, Jump Capital, Eniac Ventures, and several high-profile angels.

That’s a huge jump from their $2.3 million seed round in 2022. TrueFoundry is building a cloud-native AI deployment platform, helping enterprises train, scale, and launch AI applications without infrastructure headaches.

Several AI infra startups, including Weights & Biases and Modular AI, are chasing unique angles as the AI deployment space heats up globally.

Meanwhile, fintech keeps pulling in cash 👇

Cashfree Payments, the digital payments firm, just raised $53 million, led by Krafton and Apis Growth Fund II.

Cashfree processes $80 billion in transactions annually, serving 800,000 merchants, including Swiggy, Zepto, and Bajaj Finance.

The fresh funds will fuel cross-border payments, security innovation, and expansion into the UAE.

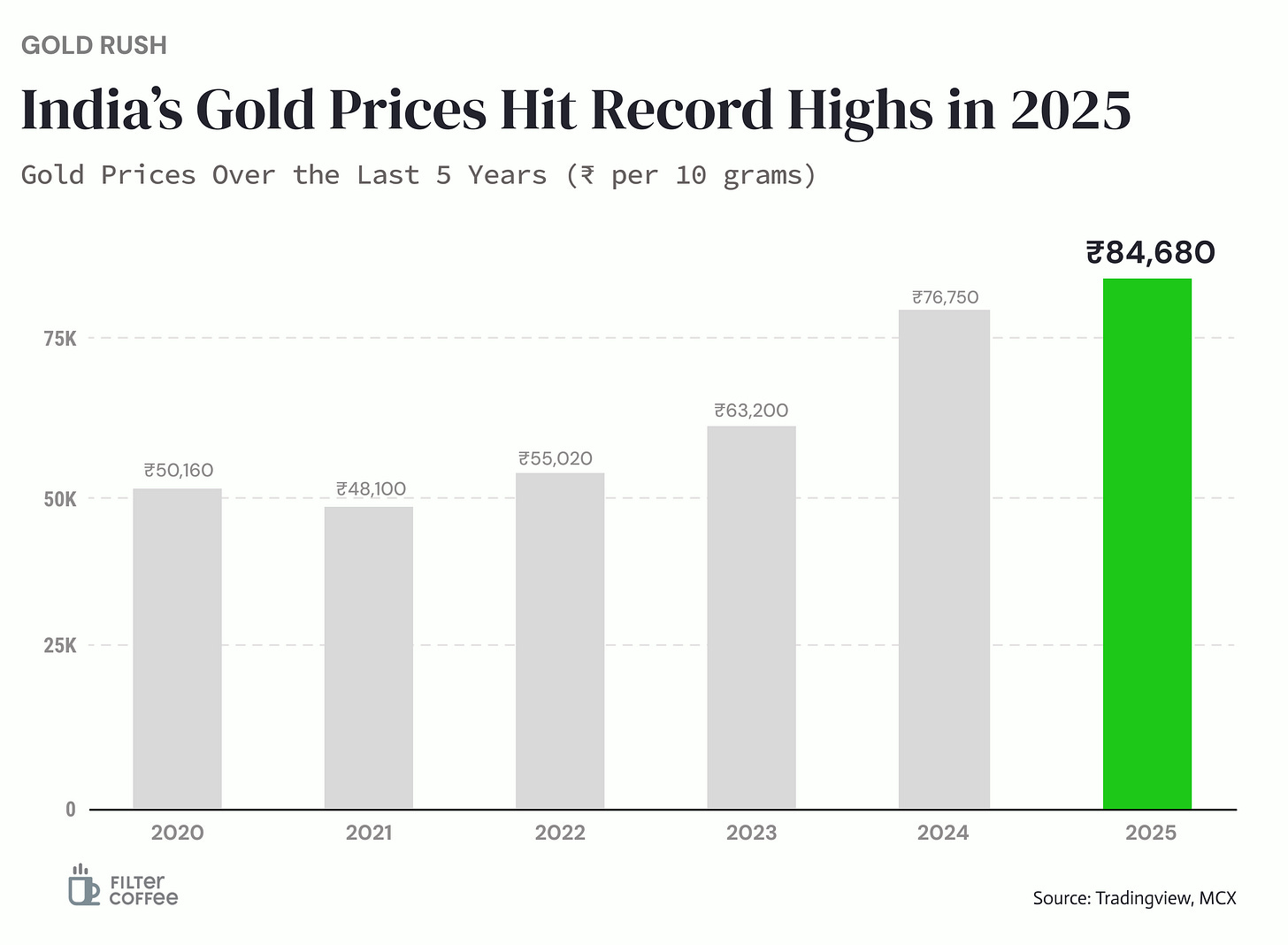

5. Chart of the day 📈

Gold prices have seen a steady climb over the last five years, reaching ₹84,680 in Jan 2025—a significant jump from ₹76,750 in December 2024.

Global uncertainties, inflation hedging, and strong domestic demand have been key drivers, solidifying gold’s position as a safe-move, as investors figure out a direction.

What else are we snackin’ 🍿

📉 Rupee slips: the rupee hit a record low of ₹87.5, down 0.1% for the day and 2% YTD.

💾 Chip play: SoftBank is set to buy Ampere, the chip company, for $6.5B, strengthening its ARM chip portfolio.

⚡EV push: HCLTech is teaming up with ChargePoint to develop next-gen EV charging software.

🏍️ Ola goes big: Ola Electric is entering the EV motorcycle market with the Roadster X Series.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.