Green energy IPO, FIIs quitting, and Major deals.

☀️ GM, hope your Monday was better than Ola’s. The company just got hit with a lawsuit for not paying a vendor, tanking stock down 5% yesterday.

On a positive note, Sensex added 0.49% and Nifty 50 jumped 0.52%.

U.S. markets meanwhile have shown a sharp reversal. Since last Thursday, the S&P is now up 2.7%. The fear of uncertainty with tariffs has mostly played out.

💡 Data Spotlight: another key metric investors watch for, wholesale price inflation (WPI), climbed to 2.38% in February, a two-month high.

In simple words, the cost of input goods for factories went up a bit. Although not a problem, if making goods becomes expensive, it may hurt corporate profit margins.

Let’s go!

1 Big thing: Retail investors keep buying 💰

Markets have been brutal this year, yet retail investors aren’t flinching.

Per ET, between October and February, domestic investors in India have invested nearly ₹1.8 lakh crore into mutual funds, despite a market that hasn’t done much for them and record outflows from foreign investors.

- 💸 Since September, foreign institutional investors (FIIs) have sold out ₹2.1 lakh crore from Indian stocks.

Retail optimism could have multiple reasons. SEBI’s decision to reduce the minimum SIP investment to ₹250 has made it easier for first-time investors to enter the market.

Young investors are also forming a growing part of India’s investor base — who also have the appetite and risk taking ability to take a counter perspective, even when the market doesn’t do much.

Worth noting: monthly SIP inflows have remained steady above ₹15,000 crore, with average investment sizes ticking up.

Big picture: amidst all the noise, India’s investor base is maturing. As they age, they’re shifting away from short-term speculation, instead viewing markets as a reliable tool to beat inflation and gain exposure to India’s growth.

2. Another green power company set to IPO ☀️

INOX Clean Energy, a clean power giant, is preparing for an IPO, looking to raise up to ₹5,000 crore at a valuation of ₹50,000 crore. The company plans to go public by 2026.

The deets: INOX Clean Energy has a diverse portfolio, spanning solar panel manufacturing to power plant operations. As an independent power producer, it generates electricity and sells it in the open market.

Most importantly, it operates under the label of the $12 billion INOX Group, which already has four listed entities, which ensures to a stable base and the support of a broadly successful operation:

- Gujarat Fluoro (battery materials)

- INOX Wind (wind turbine manufacturing)

- INOX Green (operations & maintenance for renewable energy)

- INOX Wind Energy (electricity generation & distribution)

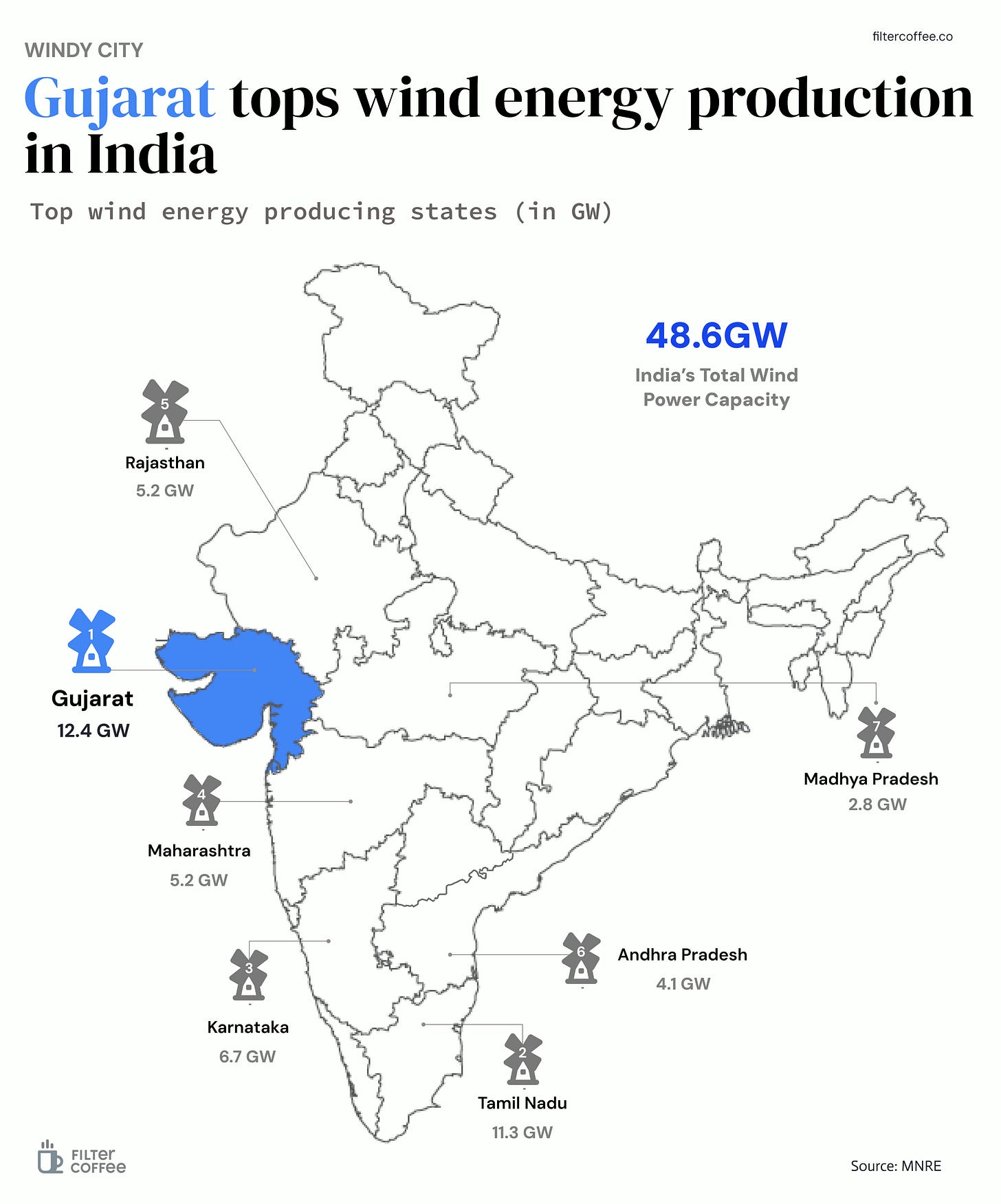

Zoom out: India’s wind energy output is set to reach 80,200 GWh in 2025, growing at 4.7% annually.

Gujarat has firmly established itself as India’s wind energy powerhouse, driven by strong wind corridors, an extensive coastline, and policies that actively support renewables.

The state continues to lead the charge, producing the highest wind energy in the country, making it a key player in India’s renewable energy push.

3. Allianz exits insurance business in India 👋

German financial giant Allianz SE will sell its 26% stake in two of its Indian joint ventures for about $2.8 billion to local partner Bajaj Group.

Bajaj will own both Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance once the deal goes through.

The timing of the liquidation is questionable, especially when global corporations are rushing to get a piece of the Indian consumer. But rumors are the relationship between both the groups had gone sour, with disagreement on the future direction of the partnership.

What next: the German giant says “Allianz will explore new opportunities that strengthen its position in the market” in a statement to Bloomberg.

What to note: India has one of the lowest insurance penetration rates worldwide, at roughly 5%, keeping it a hot market for global insurers serious about growth.

4. Major stock market moves to keep up with 🚀

- GR Infraprojects a top infra developer, popped 6.4% after winning a ₹4,200+ crore order to construct a major highway project, from National Highway Authority. The project includes building the Agra-Gwalior Greenfield Road and upgrading sections of NH-44 across Uttar Pradesh, Rajasthan, and Madhya Pradesh.

- Hindustan Construction, specializing in metro and underground tunneling projects, jumped 5.8% after bagging a ₹2,191 crore metro contract for Indore Metro. The contract, in partnership with Tata Projects, involves constructing an 8.6 km underground metro corridor with 7 stations, connecting Indore Railway Station to the airport.

- Welspun Speciality hit a 5% upper circuit after securing a ₹231 crore order from Bharat Heavy Electricals. The stainless steel and alloy products manufacturer will supply approximately 4,050 tonnes of stainless steel boiler tubes to BHEL for multiple supercritical thermal power plants.Share

What else are we snackin’ 🍿

🍏 Make in India: AirPods production is set to begin in Hyderabad, with exports starting in April. This makes AirPods the second Apple product to be manufactured in India after iPhones.

🚀 Milestone: Airtel Payments Bank crossed 1 billion transactions in January 2025, recording a 47% YoY surge across its businesses.

💳 BNPL shift: Klarna has landed an exclusive deal to provide buy now, pay later (BNPL) services for Walmart in the U.S., replacing Affirm.

🧑💻Tech collab: Ericsson, Volvo Group, and Bharti Airtel are teaming up to explore how AI and the metaverse can be used in manufacturing.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.