GDP stays steady, Nykaa's strong Q4, and Kiri cashes out.

Folks! It's a new week.

The world is busy digesting Ukraine’s latest assault on Russia. Using hundreds of FPV drones, Ukraine targeted Russian air bases deep inside the mainland, reportedly taking out over 30% of Russia’s strategic bomber fleet. The attack adds a new twist to the conflict, and serves as a wake-up call to the growing risks of drone warfare.

💡 Spotlight: India’s defence production soared to a record ₹1.46 trillion in FY25, marking a 15% jump from the previous year’s ₹1.27 trillion, according to the Defence Ministry. This milestone reflects the growing momentum behind India's push for self-reliance in defence manufacturing.

Exports too hit a new high, crossing ₹24,000 crore, up nearly 14% from FY24 levels. A standout in this growth story is the private sector, which contributed over ₹32,000 crore, or 22% of total defence output in FY25.

And there’s a bigger shift coming. For the first time ever, private companies will get to co-develop a major defence platform - the Advanced Medium Combat Aircraft (AMCA), alongside public sector units.

Let’s hit it!

1 Big thing: GDP slows but stays steady 🧮

India’s economy expanded by 7.4% in Q4, slightly below the 8.4% pace from a year ago. For the full year FY25, GDP grew 6.5%, down from 9.2% in FY24, marking a clear step down from the pandemic bounce-back years.

What worked: growth in the last quarter was driven by agriculture, construction, and capital investment.

- Agriculture surprised with 5.4% growth (vs 0.9% last year), thanks to a strong Rabi harvest.

- Construction grew 10.8%, reflecting sustained infra spending.

- Capital formation (investments in plant & machinery) rose 9.4%, showing long-term business confidence.

- Services held steady at 7.3%, led by finance, real estate, and tech.

What didn’t click: manufacturing remains the weak link. It grew 4.8%, but that’s way down from 11.2% in Q4 last year.

The road ahead: most economists expect FY26 growth around 6.3%, with inflation easing to 3.7%. India might be off the post-COVID sugar rush, but it’s still among the fastest-growing major economies in the world and if global winds don’t go rogue, the runway looks reasonably clear.

2. Nykaa delivers a strong Q4 💰

Earnings season wrapped up with another win. Nykaa posted a solid Q4, with profits nearly tripling and its beauty biz doing the heavy lifting.

By the numbers:

- Q4 revenue at ₹2,062 crore, up 24% YoY.

- Net profit soared 193% YoY to ₹20 crore down 22% compared to Q3.

The glow-up: beauty remains Nykaa’s crown jewel. Its premium brand additions, YSL, NARS, Armani Beauty, Kerastase, powered stickier retention and higher value per customer.

The drag: Fashion stayed lukewarm. Online demand remained soft, and competition from Myntra, Ajio, and Shein kept growth in check.

Zoom out: India’s e-commerce story is still being written, and Nykaa’s quick commerce push (with 100+ cities already covered) could give it the next leg of scale. But fashion will need a rethink. The stock reflected the market’s cautious optimism despite the numbers, shares dipped nearly 2% post-earnings.

Zoom out: India’s beauty industry has been riding a wave of investor love. Venture funding into beauty startups crossed $1.2 billion in 2024, with deal volume consistently rising over the last decade.

While we are on earnings,

Senco Gold delivered a strong Q4, with net profit nearly doubling on the back of robust wedding season demand.

By the numbers:

- Revenue: ₹1,378 crore, up 21% YoY

- Net profit: ₹62 crore, up 94% YoY

- Retail operations growth: 23%

What worked: this was Senco’s best-ever March quarter. High gold prices didn’t slow shoppers down, wedding demand and store traction remained strong across regions.

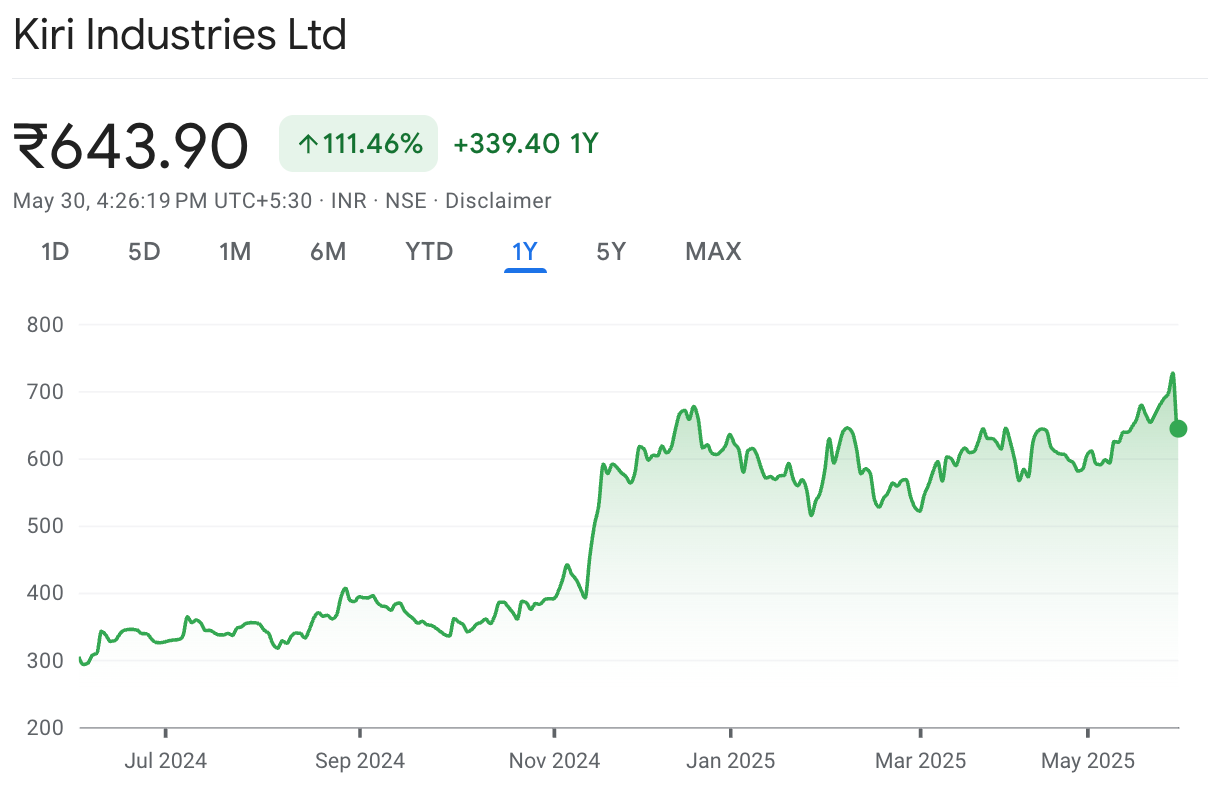

3. kiri cashes out big 💸

Indian dye-maker Kiri Industries is offloading its stake in Singapore-based DyStar to China’s Zhejiang Longsheng for $676.2 million, a deal that’s worth more than Kiri’s entire market cap of ₹3,800 crore.

Zhejiang Longsheng Group is a Chinese chemical giant with a focus on dyes, pigments, and related intermediates.

Context: Kiri and Zhejiang co-own DyStar, a global dye and chemicals manufacturer for textile and leather industries. But the two have been locked in a messy shareholder dispute for years—centered on governance, valuation, and control.

This deal not only ends that fight but gives Kiri a massive cash exit and clean slate.

Zoom out: India’s specialty chemicals sector is heating up. The industry is projected to grow from $220B in 2023 to $300B by 2025, and hit $1 trillion by 2040.

PE interest is rising too, Japan’s Mitsubishi Chemical recently sold its India unit to Advent International, and Advent also snapped up Piramal’s API business along with LANXESS.

4. BCCL heads to the bourses 🪨

Bharat Coking Coal Ltd (BCCL), a fully owned subsidiary of Coal India Ltd, has filed draft papers with SEBI for its IPO. The issue will be a pure offer for sale.

The business: BCCL is in the mining and supply of high-grade coking coal, the kind used in steel production. Raw coking coal makes up over 76% of its operational revenue.

That said, FY25 wasn’t its strongest year. Net profit dipped 20.7% to ₹1,240 crore, while revenue from operations stayed flat at ₹13,998 crore.

Zoom out: this IPO follows closely on the heels of Coal India’s other arm, CMPDIL, filing its own draft red herring prospectus earlier this month. The listings are part of a broader plan to unlock value and attract capital across Coal India’s portfolio.

5. Stocks that kept us interested 🚀

1. Marksans Pharma gets UK nod for diabetes drug 💊

Marksans' UK arm Relonchem Ltd got approval to sell a diabetes drug in liquid form.

The medication is called Metformin Hydrochloride Oral Solution, a liquid formulation used to manage type 2 diabetes,

Zoom out: type 2 diabetes affects over 100 million Indians. While tablets are the most common form, oral solutions are crucial for elderly patients, children, or those who have trouble swallowing pills.

In India, the market for oral liquid diabetes medicines is still small but growing steadily with the rise in senior citizens and diabetic cases. With this UK approval, Marksans is opening up a high-margin niche where fewer players mean better pricing power.

2. Reliance Power’s solar charge ☀️

Reliance Power jumped 11% after bagging a 350 MW solar + 175 MW storage project from SJVN, sending the stock to a 10-year high.

A 350 MW solar project can power over 2 lakh homes annually, generating around 613 million units of clean electricity.

The project will add 600 MW of solar DC capacity and 700 MWh of storage to Reliance Power’s clean energy portfolio. With this, the company now boasts India’s largest pipeline in the integrated Solar + BESS segment, totaling 2.4 GW of solar and 2.5 GWh of storage.

Zoom out: Reliance Power’s stock has been on a tear, up 50% in just a month and 140% over the past year. Friday’s surge came with 2x the usual trading volumes, showing rising investor interest.

What else are we snackin’ 🍿

📶 Signal swing: India added 1.9M mobile users in April, with Jio leading the gains while Airtel’s growth slowed and active users dropped sharply.

🍏 Third bite: Apple is set to open its third India store in Bengaluru’s Phoenix Mall of Asia, after Mumbai and Delhi.

🧵 Snitch up: Menswear brand Snitch raised up to $40 million in a Series B round led by 360 ONE Asset.

⚡ Power cool: India’s power consumption dropped 4% YoY in May 2025 to 148.7 billion units, as early monsoons and unseasonal rains curbed electricity demand.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.