Biggest quantum bet, Pizza party, and A nuclear deal.

🗓 Morning, folks!

Markets extended their losing streak for the sixth straight session, but there was a silver lining.

While Nifty and Sensex remained in the red, the mid-cap index bounced back over 1,600 points, signaling some much-needed relief. Expect some volatility to continue until the market finds a clear direction.

Let’s hit it.

1 Big Thing: Inflation Takes a Breather 📈

India’s inflation finally cooled in January, giving consumers and policymakers some much-needed relief.

The deets: Retail inflation dropped to 4.31%, down from 5.22% in December, marking the first time in five months that price pressures have eased. A Reuters poll had predicted 4.6%, so the drop was sharper than expected.

- Rural inflation slid to 4.64% from 5.76%

- Urban inflation declined to 3.87% from 4.58%

Just three months ago, inflation had surged to a 14-month high of 6.2%.

The biggest driver: Food prices, which make up nearly half of India’s inflation index, cooled significantly. Food inflation fell to 6.02% from 8.39%, thanks to fresh winter produce and a strong autumn harvest improving supply chains.

But staples like cereals and pulses remain pricey, keeping some pressure on household budgets.

What this means: for consumers, it means some relief at grocery stores as food prices stabilize.

For businesses, easing inflation keeps costs in check, especially for food and FMCG companies.

But most importantly, for the RBI, this strengthens the case for another rate cut after February’s 25 bps reduction to 6.25%.

Zoom out: with inflation now well within the RBI’s 2-6% target band, the focus shifts to economic growth. And quite frankly if this growth holds, RBI’s job becomes 10x easier to cut rates and spur growth. Markets will love that.

2. India & France Go Nuclear 🔥

India and France signed a deal to co-develop Small Modular Reactors (SMRs) and Advanced Modular Reactors (AMRs) as part of a broader push to expand nuclear energy.

India’s love for nuclear power isn’t new, if you remember, the government recently launched a ₹20,000 crore Nuclear Energy Mission, aiming to deploy at least five indigenous SMRs by 2033 and triple nuclear capacity by 2032.

SMRs are small, modular nuclear reactors designed for safer, more flexible power generation. They require less space, can be built faster, and support clean energy goals.

The deal was finalized during PM Modi’s meeting with French President Emmanuel Macron in Paris.

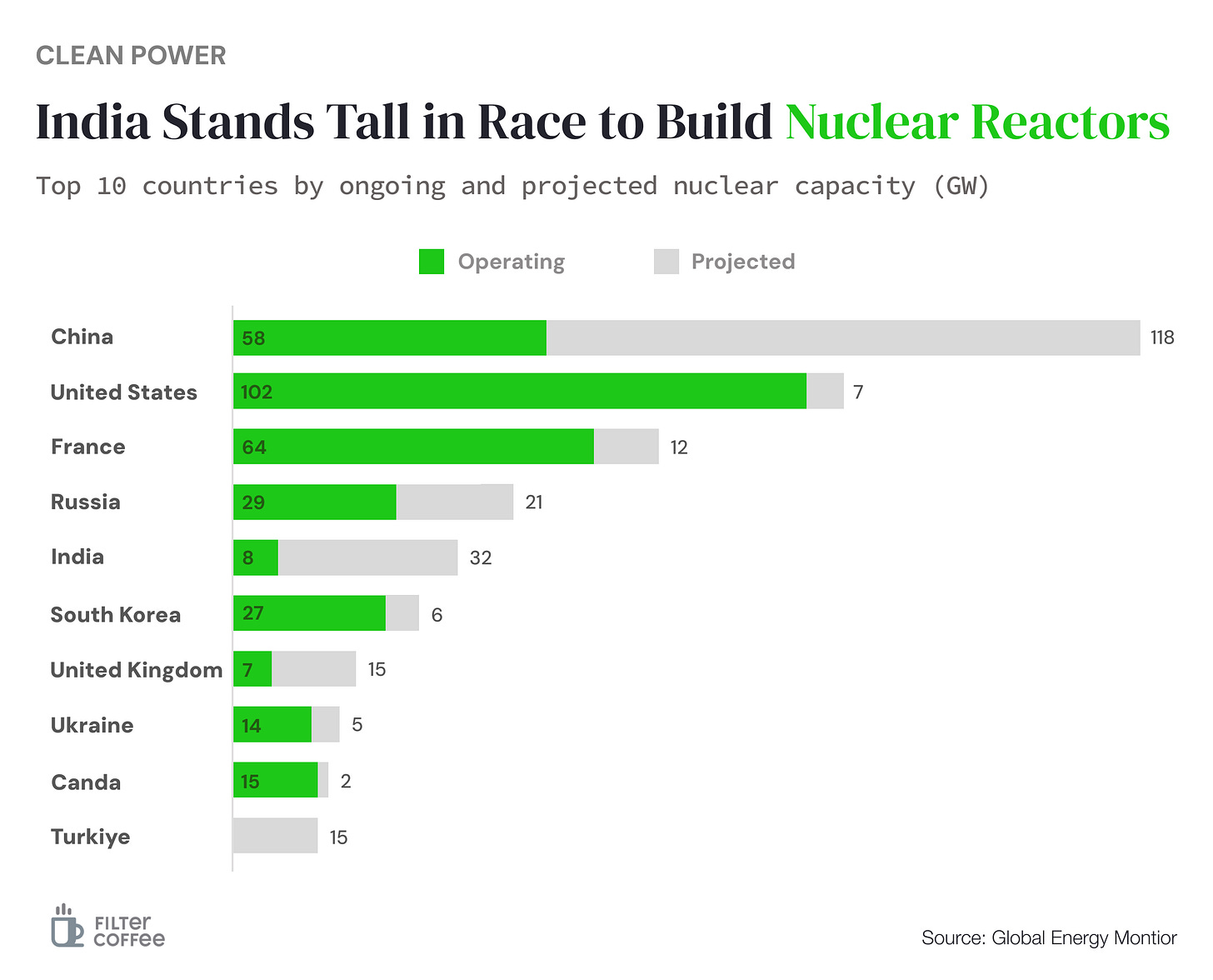

Why it matters: Nuclear energy currently makes up just 1.8% of India’s total power capacity, far below global averages. The government wants to scale this to 100 GW by 2047 to secure long-term energy stability.

And given the abundance and power density of nuclear as a source, this is quickly turning into an arms race for major industrialized and emerging economies as energy security becomes a major theme.

3. Mamaearth’s fading glow 💄

Mamaearth, posted another flat Q3, with profits barely budging while revenue ticked up modestly.

By the numbers: Revenue rose 6% YoY to ₹518 crore, but net profit came in at ₹26 crore, almost unchanged from last year.

Mamaearth’s offline expansion through Project Neev continued, which BTW aims to replace super-stockists with smaller, direct distributors in major cities, giving the brand closer control over inventory and better sales data.

The company is now shifting to direct distributors across the top 50 cities.

Beyond Mamaearth, its emerging brands, Derma Co, BBlunt, Dr. Sheth’s, Aqualogica, and Staze 9to9—grew over 30% YoY, adding some respectable momentum to its portfolio.

Worth noting: Honasa is betting big on quick commerce, where sales surged 200% YoY in 9MFY25. But with Blinkit, Swiggy Instamart, and Zepto making brand discovery easier than ever, competition is heating up.

Regardless, markets weren’t too impressed—stock closed slightly lower after the results.

Dalal Street had a Pizza party,

Jubilant FoodWorks, the operator of Domino’s and Popeyes in India, posted a pretty solid quarter but got pulled back a bit by rising costs.

Revenue jumped an impressive 56% YoY to ₹2,150 crore, but net profit slipped 35% to ₹43 crore.

Domino’s, which drives the bulk of Jubilant’s business, saw 18.3% revenue growth, fueled by a 33.8% jump in orders. The company added 67 new stores, bringing its total to 2,266 locations.

Internationally, Sri Lanka hit record revenue growth of 65%.

Zoom out: despite all the shift towards healthy eating, QSR still remains a booming market in India, and the appeal of western brands as an exceptional premium commodity is unrivalled.

Jubilant stock closed down 4%. An opportunity?

4. Quick IPO in focus 🔍

Indira IVF has filed for a ₹3,500 crore IPO, opting for a confidential filing

This makes it the sixth company to take the confidential route after Tata Play, OYO, Swiggy, Vishal Mega Mart, and Credila Financial Services.

Confidential filings allow companies to keep financials and business data private until they finalize their public issue.

The offer is entirely an offer for sale (OFS), with EQT set to receive ₹2,900 crore and the promoter group taking ₹600 crore.

EQT Asia, which acquired a majority stake in Indira IVF for $1 billion last year, has been aggressive in India, investing $6 billion across ventures in the past 18 months.

Big theme: India’s IVF market is booming, projected to surpass $3.7 billion by 2030, up from $793 million in 2020.

5. Quick trip down venture lane 🤝

Whole Truth raised $16 million in a Series C round led by Sofina Ventures.

The company makes clean-label snacks, think protein bars, nut butters, and dark chocolate, with a mission to rebuild trust in food.

The fresh capital will help expand operations and launch new products, as demand for healthier snacking continues to rise.

The global healthy snacks market size was valued at US $78.13 billion in 2019 & is projected to reach US $108.11 billion by 2027.

What else are we snackin’ 🍿

🚀 Kotak’s back: RBI removed restrictions on Kotak Mahindra Bank, allowing it to onboard new customers and issue fresh credit cards again.

📈 Demat boom: CDSL registered a record 15 crore demat accounts, becoming the first depository in India to hit the milestone.

💰Mega bonus: AI startup Covai.co gave a ₹14 crore bonus to 140 employees, equal to six months' salary.

🔒Safe Insta: Meta rolled out a separate Instagram space for teens, aiming to make the platform safer and age-appropriate.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.