Defense deals heat up, EV dreams, and Edtech slows down.

🗓 Morning and Happy Monday!

The markets are hell bent on sticking it to Trump on his tariff assault. Friday was brutal. So was Monday in the US. The question is, how much further can Donald take it, before he caves?

💡 Spotlight: Gold is having a moment. Prices hit a record high on Friday as investors look for safe bets. U.S. futures hit $3,083.60/oz and back home, gold is trading near ₹71,500/10g on the MCX, tracking the global surge.

Let’s hit it.

1 Big Thing: Krafton goes all in on cricket gaming 🏏

Krafton, the South Korean gaming giant, acquired a controlling stake in Nautilus Mobile for $14 million in an all-cash deal.

The deets: Nautilus builds cricket-based mobile games like Real Cricket 24 and Real Cricket Premier League. Krafton is best known for its blockbuster titles, PUBG: Battlegrounds and Battlegrounds Mobile India (BGMI), which have gained massive popularity worldwide.

The new plan: with cricket holding a special place in the hearts of millions of Indians, Krafton sees this acquisition as an opportunity to move beyond BGMI and explore new genres that appeal to Indian gamers. It plans to scale Nautilus’s titles globally too and bring the firepower to take the franchise beyond India.

Worth noting: this isn’t Krafton’s first swing. It invested $5.4 million in Nautilus back in 2022 and is now going all in.

Krafton’s net profit jumped 119% YoY to ~$889 million in 2024. BGMI alone crossed 200 million downloads in India and hit record sales last year.

Zoom out: mobile games now make up nearly 78% of India’s gaming revenue, with the market projected to hit $1.1 billion by 2028.

While we are on acquisitions,

PhysicsWallah is acquiring 26-year-old UPSC coaching giant Drishti IAS in a ₹2,500–3,000 crore deal, per Entrackr.

The acquisition adds offline scale to PhysicsWallah’s UPSC vertical, giving it a massive physical footprint in premium coaching markets as PW gears up for its IPO.

2. BYD plans India factory 🔌

Chinese EV giant BYD is making a fresh push into India, with plans to set up its first manufacturing facility near Hyderabad.

Although available in India since 2021, BYD is currently importing cars. If finalised, Telangana will become the first Indian state to host a BYD factory.

The deets: BYD is one of the world’s largest EV makers, known for its affordable cars and cutting-edge battery tech. The proposed Hyderabad plant is part of its larger India strategy—to tap into one of the fastest-growing EV markets globally.

The backstory: this isn’t BYD’s first India attempt. In 2023, its $1 billion proposal with Hyderabad-based Megha Engineering was rejected due to restrictions on Chinese investments. But the company stayed active through a partnership with Olectra Greentech, which operates electric buses across India using BYD tech.

BYD’s ambition doesn’t stop at car assembly—it also plans to set up a 20 GW battery plant and scale production to 600,000 EVs annually over the next few years.

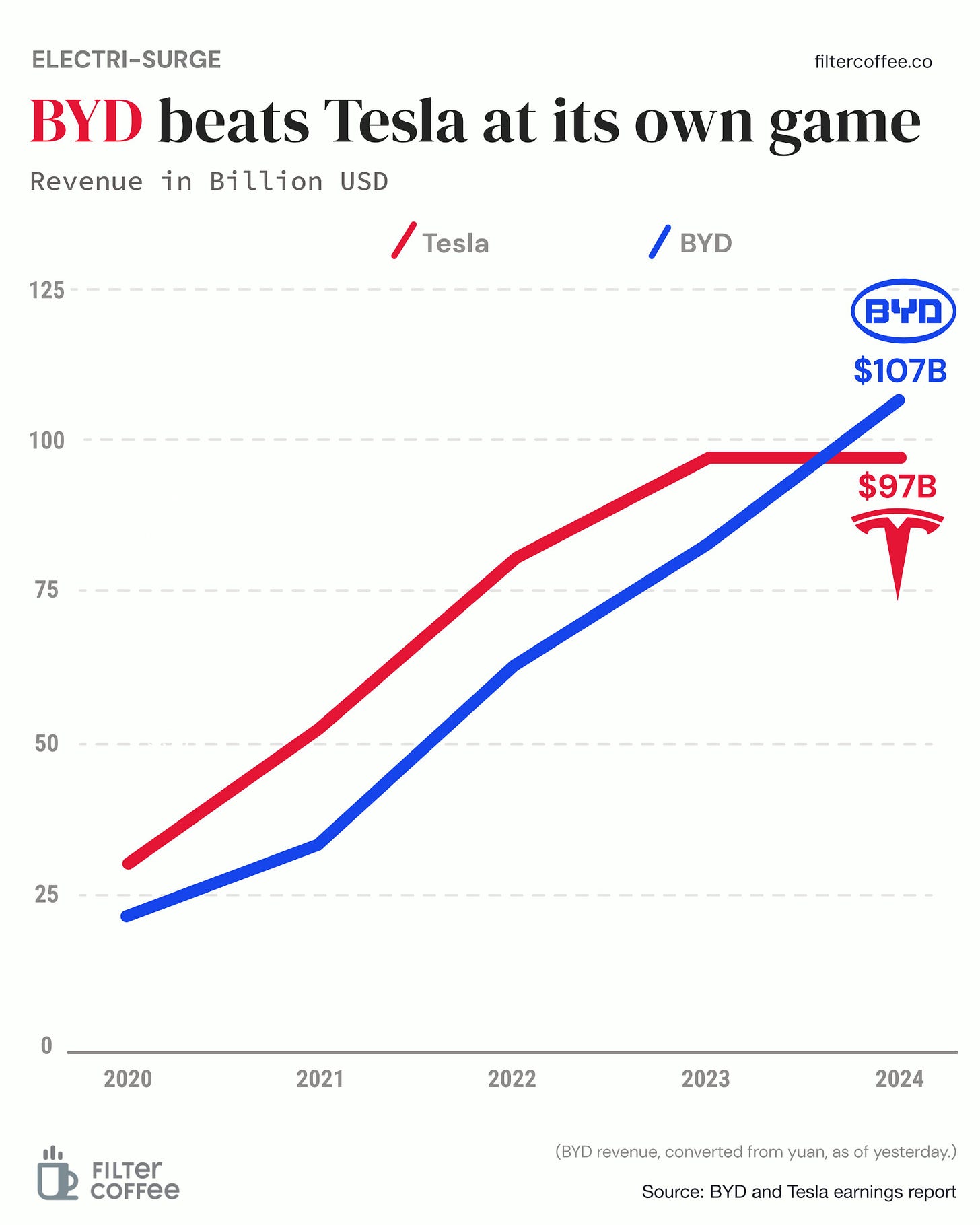

Big picture: India and China are warming up diplomatically after years of tension. Moreover, BYD also hopes to beat Tesla in getting to India.

3. Foxconn is doubling down iPhone production in India 🛠️

Apple’s India bet is getting bigger—and Foxconn is leading the charge.

The deets: Foxconn plans to manufacture 25–30 million iPhones in India in 2025, more than double last year’s 12 million. Trial runs are already underway at its massive new 300-acre facility in Bengaluru, which is expected to be Apple’s second-largest iPhone plant after China.

If successful, the site will begin full-scale production later this year, helping Apple hit its goal of making up to 25% of all iPhones in India by the end of 2024.

The shift also highlights India’s growing role in the global electronics supply chain, with iPhone, AirPods, and even server manufacturing being scaled up across the country.

4. Quick IPO in focus 💰

Pace Digitek, a Bengaluru-based telecom infra firm, has filed preliminary papers with SEBI for an IPO to raise up to ₹900 crore.

The deets: founded in 2004, Pace provides telecom tower infrastructure, optical fibre cable services, and passive infra solutions across telecom, energy, and tech sectors.

What’s new: the IPO is a pure fresh issue, though the company may raise ₹180 crore via pre-IPO placement. Proceeds will fund capital expenditure and general corporate purposes.

By the numbers: Pace has scaled rapidly, FY24 revenue surged nearly 5x to ₹2,434 crore, while profit jumped to ₹229.9 crore.

Why it matters: India is in the middle of a massive infrastructure overhaul—fueled by 5G rollouts, power upgrades, and digital connectivity. Players like Pace are quietly building the backend of this new economy, and investors are taking note.

5. Stocks that kept us interested 🚀

1. HAL wins massive defence order 🚁

Hindustan Aeronautics Limted (HAL)received a ₹62,700 crore order from the Indian government to supply 156 Light Combat Helicopters (LCHs).

The deets: HAL is India’s top aerospace and defence manufacturer, building everything from fighter jets to choppers. The LCHs, nicknamed Prachand, are specially designed for high-altitude warfare and can take off from altitudes above 5,000 metres—perfect for operations in Siachen and Ladakh.

Zoom out: with this deal, India’s total defence procurement for FY25 has crossed a record ₹2.09 lakh crore. It’s a major win for Make in India and signals growing confidence in HAL’s ability to deliver complex, large-scale defence systems.

2. Force motors bags big military order 🔧

Force Motors ended over 2% higher on Friday after bagging a contract to supply 2,978 vehicles to the Indian Defence Forces.

The deets: Force Motors makes commercial and utility vehicles, and is known for its rugged Gurkha 4x4.

What’s cooking: these vehicles are ideal for border patrols, logistics runs, and field operations. The deal cements Force Motors' place as a key supplier in India's growing defence logistics network.

7. Story in data: Edtech Slowdown 📊

India’s edtech sector was the poster child of pandemic-era capital.

$4.8B poured in at peak hype in 2021, but just $600M in 2024 shows how quickly sentiment flipped. As investor focus shifted to profitability, many edtech startups couldn’t make the grade.

Deal counts are at a decade-low, and the funding environment remains tight.

The market’s moved on, and edtech is learning that scale without retention doesn’t score anymore.

What else are we snackin’ 🍿

💾 Chip boost: the government approved a ₹25,000 crore PLI scheme to ramp up electronic component manufacturing in India.

📈 Fund game on: Blackstone-backed ASK Group got SEBI’s nod to enter the mutual fund biz.

📡 More Vi: Centre is raising its stake in Vodafone Idea to 49% by converting ₹36,950 crore in spectrum dues into equity. It already owns 22.6%.

🚘 Wheels up: Renault will buy out Nissan’s 51% stake in their India JV, becoming sole owner of RNAIPL as part of their global restructuring.

🌍 Debt check: India’s external debt hit $717.9 billion at the end of Dec 2024, up 10.7% YoY.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.