MRF leads again, AI grabs heat up, and Meta goes nuclear.

🗓 Morning, folks!

Markets couldn’t shake off the blues on Tuesday, closing lower for the third straight day. Weak global cues and a sell-off in heavyweight names dragged both the Sensex and Nifty into the red.

But it wasn’t all doom and gloom. Fertiliser stocks saw a nice pop thanks to early monsoon optimism (more rain = more farming = more fertiliser), and shipyard stocks like Cochin Shipyard and Garden Reach sailed ahead with gains of up to 6% on strong buying interest.

Spotlight: MRF is back on top as India’s most expensive listed stock, edging past Elcid Investments after the latter’s steep slide over the past six months.

At market close on June 3, MRF shares ended at ₹1,37,834 a piece, overtaking Elcid’s ₹1,29,300/share.

Elcid had shocked the Street back in October 2024, skyrocketing 66,92,535% in a single day from ₹3.53 to ₹2,36,250, briefly dethroning MRF.

Let’s hit it!

1 Big thing: Meta makes a nuclear bet 🤝

Meta has signed its first-ever nuclear energy deal, locking in a 20-year agreement with Constellation Energy to secure power for its growing data center needs.

Constellation is the largest producer of carbon-free energy in the U.S., operating a fleet of nuclear, solar, wind, and hydro assets.

The deets: starting June 2027, Meta will buy 1.1 gigawatts of electricity, the entire output of the Clinton Clean Energy Center in Illinois, a nuclear plant owned by Constellation Energy.

The why: AI and cloud demand is exploding. Meta’s data centers need massive amounts of electricity, and the company wants that to be 100% clean. This deal helps lock in stable, low-carbon power for the long haul.

The how: the nuclear plant won’t directly power Meta’s servers. Instead, it feeds the regional grid, but Meta will claim the clean energy credits to meet its renewable goals.

Zoom out: Nuclear is making a comeback as big tech chases clean, reliable, around-the-clock power. As AI workloads skyrocket, traditional renewables like solar and wind aren’t enough on their own.

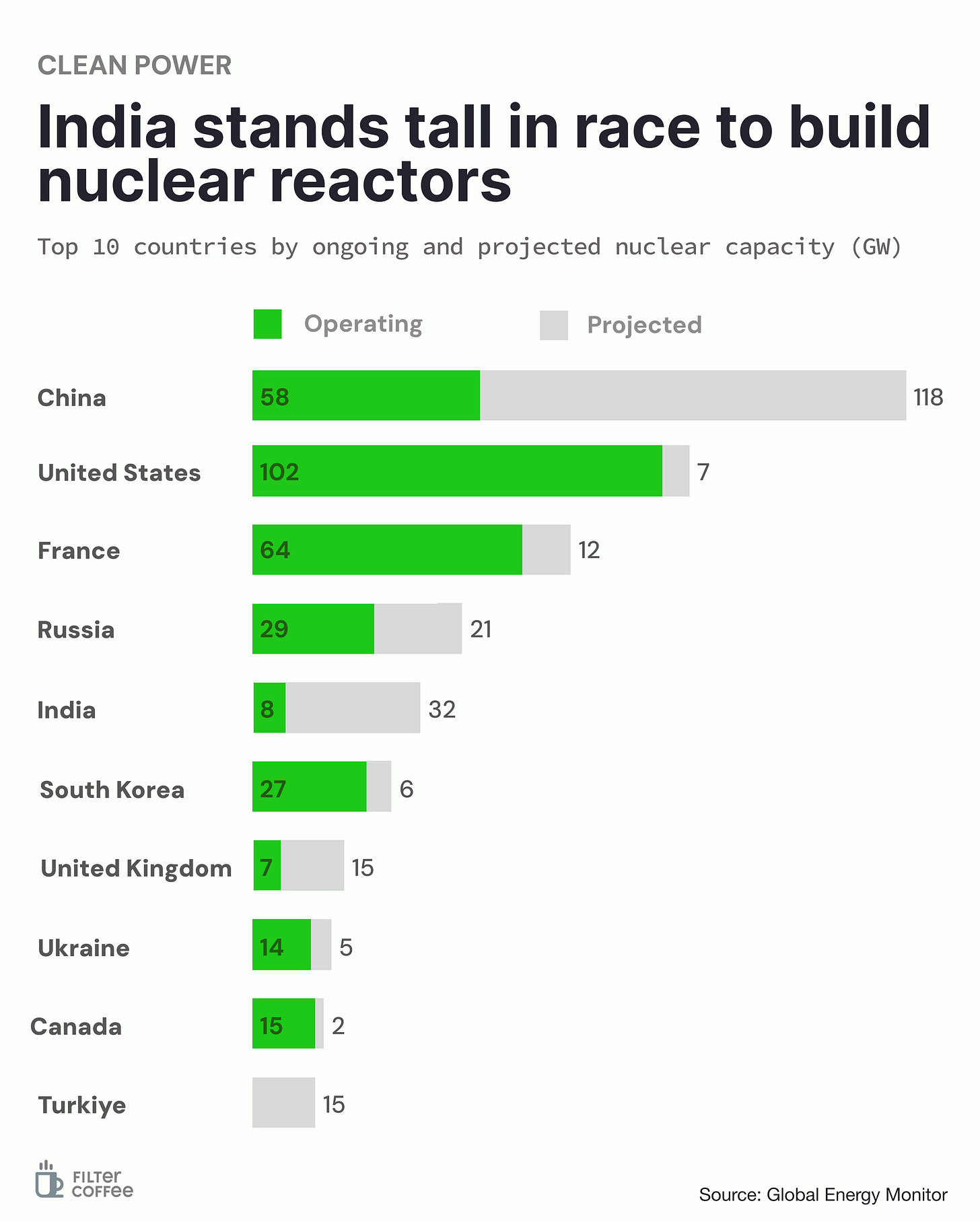

India may not have Meta’s data center appetite yet, but it's gearing up, with 32 GW of nuclear capacity planned, it's now among the top 5 countries betting on atomic power.

2. IPO season reloaded 📈

1. HDFC’s HDB gets IPO greenlight 💸

HDB Financial Services, the NBFC arm of HDFC Bank, just got SEBI’s approval for a massive IPO, set to be the biggest NBFC listing ever.

The deets: the IPO will raise ₹12,500 crore through a ₹10,000 crore offer-for-sale by HDFC Bank and a fresh issue of ₹2,500 crore. HDFC Bank currently owns 94.4% of HDB and will continue to hold a majority post-listing.

This comes as the fifth-largest IPO in India’s history.

The backdrop: HDB was founded in 2007 and offers both secured and unsecured loans. It’s been on the IPO radar for years, but compliance issues like excess shareholders and ESOP irregularities delayed the process.

SEBI’s approval now clears the deck for launch, just as another upper-layer NBFC, Tata Capital, readies its own ₹15,000 crore IPO.

2. The Lalit Group eyes an IPO (again) 🏨

The Lalit Suri Hospitality Group is once again warming up to a public listing.

Its hospitality business, Bharat Hotels Limited, is eyeing an IPO post-2026, nearly seven years after it shelved its previous listing plans due to Covid and market turbulence.

Big picture: the IPO buzz is back in India’s hospitality space. Just this week, Brookfield-backed Leela Hotels raised ₹3,500 crore via its BSE debut. Prestige Hospitality Ventures filed a ₹2,700 crore DRHP. Brigade Group is also planning a listing of its hotels arm.

If timing aligns, The Lalit could tap into a red-hot listing window.

3. Aequs takes the confidential route 💰

Contract manufacturing player Aequs is prepping to raise up to $200 million via a confidential IPO filing with SEBI. The issue will be a mix of fresh shares and an offer-for-sale (OFS),

Zoom out: Aequs makes high-precision parts for aerospace and consumer durables, operating integrated manufacturing clusters in Belagavi, Hubballi, and Koppal. These hubs handle everything from machining, forging to surface treatment under one roof.

With global supply chains looking for resilience and reliability, Aequs is pitching itself as a vertically integrated answer to global Original Equipment Manufacturers (OEMs).

Worth noting: India’s IPO momentum is clearly building, 2025 has already seen 85 DRHPs filed by May, putting it on track to surpass recent years.

3. Flipkart to exit ABFRL With ₹600 cr block deal 🧳

Walmart-owned Flipkart is looking to offload its entire 6% stake in Aditya Birla Fashion & Retail (ABFRL) via a block deal worth around ₹600 crore, marking a clean break from the fashion major.

A block deal is a high-value transaction where large chunks of shares are bought or sold between two parties through a separate trading window on the stock exchange.

Backstory: Flipkart first invested ₹1,500 crore in ABFRL back in 2020 to take a 7.8% stake, later trimmed to 6%. The idea was to deepen its fashion play by expanding premium brand offerings on Flipkart and Myntra while boosting ABFRL’s omni-channel muscle.

Why it matters: the deal signals the end of a B2B-era tie-up. Flipkart says the exit is a “natural evolution,” as it now doubles down on internal fashion labels and platform-led growth. For ABFRL, the decoupling may lead to more strategic realignment as competition intensifies across e-commerce and branded retail.

Zoom out: with Reliance and Tata pumping billions into fashion and Flipkart shifting focus, the landscape is getting reshaped fast—and capital is moving accordingly.

4. Stocks that kept us interested 🚀

1. L&T wins ₹2,500 crore Rajasthan water project 💸

Infrastructure giant Larsen & Toubro secured significant orders ranging between ₹1,000–2,500 crore from the Rajasthan government.

The deets: the company’s water and effluent treatment division will execute two major Engineering, Procurement, and Construction (EPC) projects aimed at improving water supply in rural areas.

Project 1: L&T will lay 5,251 km of pipelines and build 190+ structures to deliver clean water to 285 villages and 2 towns in Rajasthan’s Jhunjhunu district.

Project 2: in Ajmer’s Kekri-Sarwar region, it will add 43 km of pipelines to boost the local water network.

Why it matters: clean water is still a big challenge in rural India. L&T’s projects aim to improve access and tackle health issues like fluorosis from high fluoride levels.

2. Waaree wins ₹346 crore solar project ☀️

Waaree Renewable Technologies bagged ₹346 crore solar project from Calcutta Electric Supply Corporation (CESC) to scale its EPC portfolio.

The deets: Waaree will build a 300 MW AC / 435 MW DC ground-mounted solar project—enough to power over 2 lakh Indian homes annually, depending on sunlight and consumption.

Why it matters: as demand for clean power surges, full-stack solar execution gives Waaree more control—faster rollout, tighter cost efficiency, and end-to-end delivery.

This utility-scale project deepens Waaree’s solar footprint and unlocks bigger revenue potential across the value chain.

Big picture: India is chasing 500 GW of non-fossil energy by 2030. With both manufacturing and EPC under one roof, Waaree is betting big on becoming India’s most integrated solar powerhouse.

What else are we snackin’ 🍿

🛡️ More missiles soon: Russia to finish S-400 air defence system deliveries to India by 2026.

📉 Staff squeeze: Microsoft cuts hundreds of more jobs weeks after major layoffs, even as AI investments keep rising.

🏆 RCB breaks curse: after 18 long years, Royal Challengers Bengaluru finally lifted their maiden IPL trophy, edging out Punjab Kings by 6 runs in a thrilling 2025 final in Ahmedabad.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.