☀️ Morning, this week was short.

👑 Gukesh D is the new and the youngest ever world chess champion.

🔔 Trump rang the bell at the NYSE yesterday, joined by top figures of American business, meant to be a show of force.

📈 Market-wise, not the best of weeks for India, with the Sensex and Nifty both finishing down half a percent.

Let’s hit it.

1 Big Thing: Reliance's Russian Roulette🛢️

Reliance signed a massive oil supply deal with Russia's state backed oil company Rosneft. The agreement is noted as the largest ever between India and Russia.

What matters: the mega-deal, valued at approximately $13 billion annually, secures nearly 500,000 barrels of crude oil per day—which would account for 0.5% of the world’s total oil supply.

Context: Rosneft is central to Moscow’s energy strategy. Ever since the Americans imposed sanctions and cut Russia from the global oil market, India has been a critical buyer helping keep things going.

For India, it was pure business. Cheap oil for its citizens and some refining money for its local businesses.

The hype: Sanctions made Russian oil $3 to $4 cheaper per barrel than rival grades. With India’s massive and growing energy needs, any discount is a win.

Zoom out: What once seemed like a risky move—siding with Russia—has proven strategically smart for India, enhancing its geopolitical leverage and promoting energy independence.

For Russia, it meant a lifeline for its oil industry, thanks to the insatiable appetite for energy of the Indian consumer.

2. Stocks that kept us interested 🚀

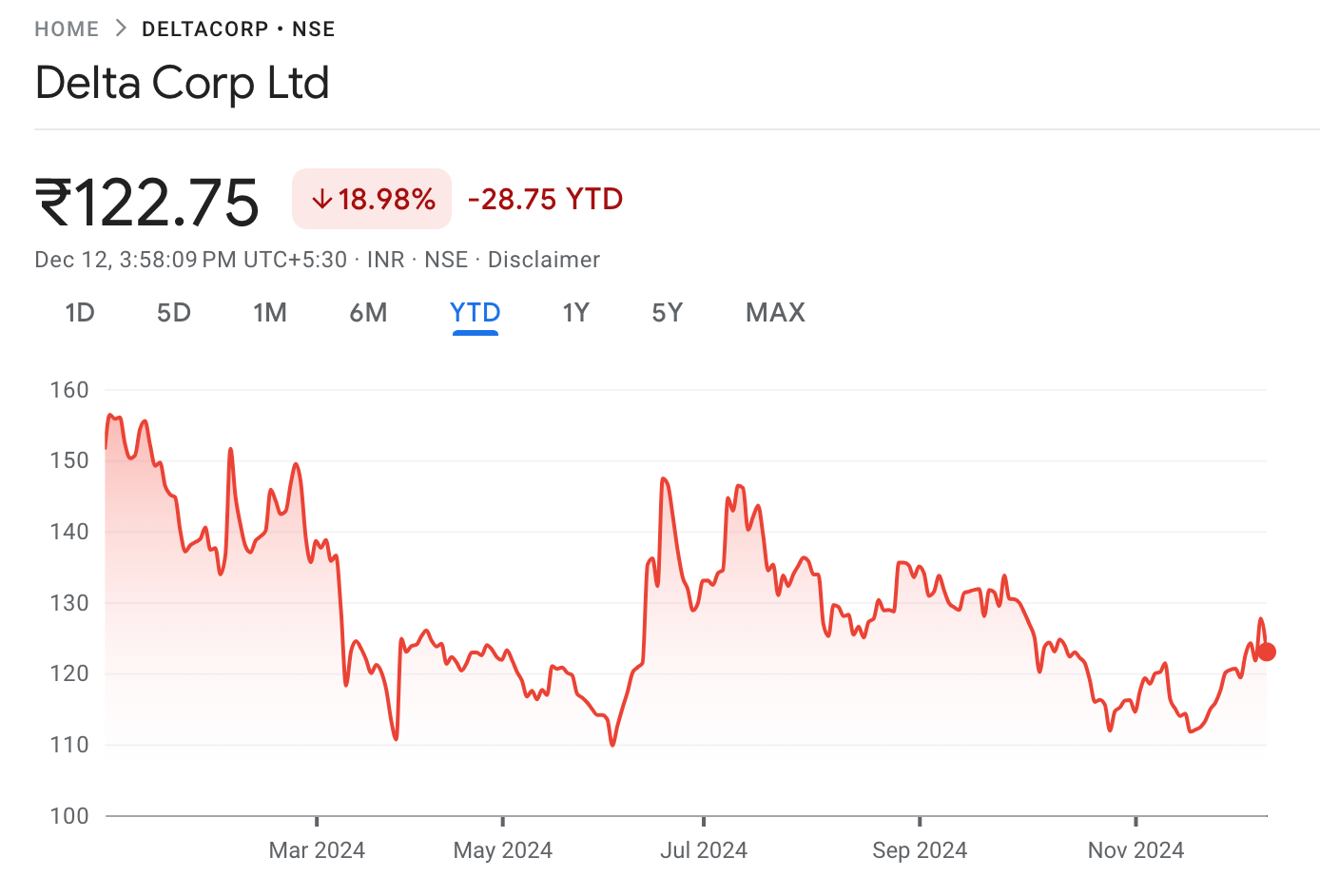

Delta Corp’s stock jumped 8% this week after the Chief Economic Advisor's comments supporting innovation in cryptocurrencies and online gaming.

Context: Delta owns and operates casinos in Goa and Sikkim, and is a key player in India's regulated gaming market. Their portfolio includes physical casino properties like Deltin Royale and digital gaming platforms like Adda52.

By the numbers: despite the jump this week, Delta's stock is still down over 15% in 2024. Revenues are declining fast. But the company trades at just 22 times earnings and has a nice dividend. Has it floored?

Avenue Supermarts shares fell as much as 3% this week as the market continues to worry about the rapid growth of quick commerce and what that could do to the urban grocery market.

Context: in the last several weeks alone, multiple new companies including Amazon and Flipkart have announced full-blown quick commerce offerings, across categories.

While quick commerce growth is likely to take time, consumer expectations are forming very fast.

By the numbers: D-mart’s stock has slipped over 8% in the past 12 months. And yet, for the most recent quarter, the company grew sales by nearly 14% YoY. Too much fear in the market?

3. What went down in the markets 📈

The IPO market continues to draw positive attention.

- Bluestone, which sells jewelry online, filed draft papers for its IPO. The IPO will include new equity issuance of roughly ₹1,000 crore, along with liquidation by existing investors. The company is backed by some big league players including Accel and Peak XV Partners. A dominant force in India’s nascent online jewelry market, the company sells a range of contemporary diamond, gold, platinum and studded jewelry for young buyers.

- Aye Finance Limited, an SME-focused non-banking finance company, is looking to raise up to ₹1,450 crore through its IPO. The company is backed by Elevation capital and offers loans to small businesses that banks would never dare lend to.

4. Who got the bag? 💸

This week’s funding scene feels like a throwback to 2021, with startups raising capital like there's no tomorrow.

Quick look at a few major raises from venture town:

- Solarsquare, a solar power startup, bagged $40 million led by Lightspeed in the Series B funding round. The company plans to use the funds to upscale operations, double workforce, and amp up branding. Solarsquare specializes in end-to-end rooftop solar installation and maintenance services, handling everything from government permits to financing.

- FirstClub, a rapid delivery startup, raised $8 million, with Accel and RTP Global leading the charge. The startup plans to sell premium products in the packaged foods, fresh foods, bakery, dairy, and nutrition categories to the top 10% of the Indian population residing in metro cities. FirstClub will focus on Bengaluru for the first 12 months.

Rebel Foods, which operates cloud kitchens, has raised $210 million in a Series G round that includes the sale of new and existing stock, valuing the company at $1.4 billion. The company plans to use the funds to expand overseas, leverage AI technologies, and scale operations across its 450 dark kitchens while preparing for a potential IPO by 2026.

What else are we snackin’ 🍿

🇹🇭Thai visa upgrade: Thailand is launching an e-Visa system for Indian passport holders starting January 1, 2025.

✈️AI takes flight: GMR Hyderabad Airport launches an AI-powered digital twin platform to streamline operations across all its airports.

🍽️Snack wars begin: Blinkit debuts Bistro, a 10-minute snack delivery app, in a head-to-head race with Zepto Cafe.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.