Digital payments are thriving, but so are the scammers.

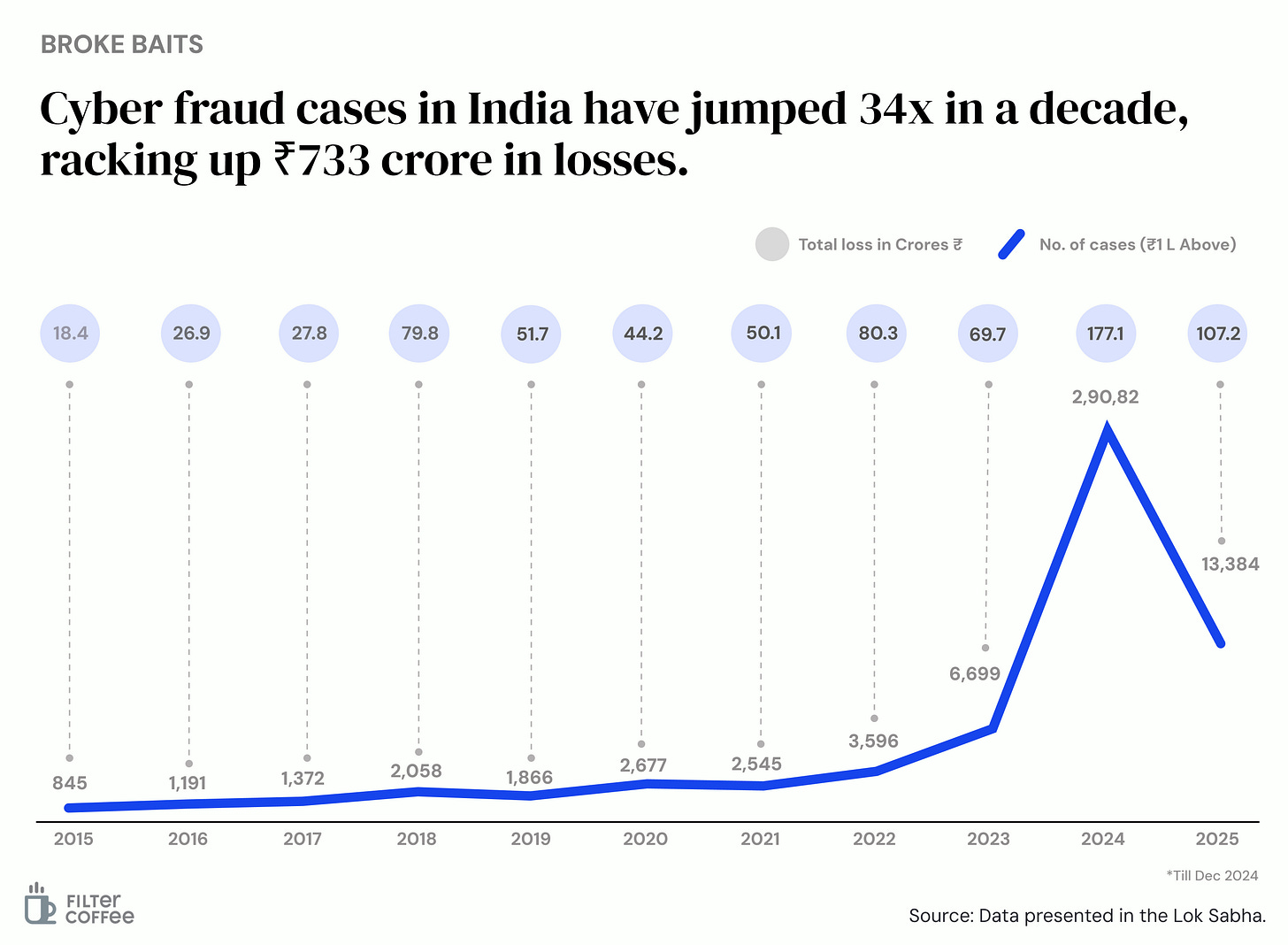

India lost ₹107.2 crore to cyber fraud in the first three quarters of FY25, with 13,384 cases reported

The deets: fraud in card, internet, and digital transactions is increasing rapidly. High-value fraud (₹1 lakh+) reached ₹177 crore in FY24, a steep jump from ₹18.4 crore in FY15.

Why it matters: as digital payments become the norm, cyber fraud is rising just as fast.

The government isn’t sitting idle. CERT-In, India’s cybersecurity watchdog, is rolling out security audits and mock drills to catch vulnerabilities before they become full-blown crises.

Meanwhile, RBI is tightening KYC checks and has set up a market intelligence unit to track fraud trends in real time.

But here’s the catch…

Even with the rise in fraud, India’s digital payment ecosystem is breaking records. UPI transactions hit 17 billion in January, up 1.6% from December, while transaction value climbed to ₹23.4 trillion. Compared to last year.

While we are on cyberattacks, X just got hit—hard.

Elon Musk claims the platform faced a "massive cyberattack" yesterday, potentially from a large, coordinated group or even a nation-state.

Downdetector logged over 40,000 outage reports globally, with thousands of users in the U.S. and U.K. locked out.

The cause? Still unclear. But Musk’s take? This wasn’t just a glitch.