Maruti's roadblocks, Credit card boom, and Venture town hot.

🗓 Morning, folks!

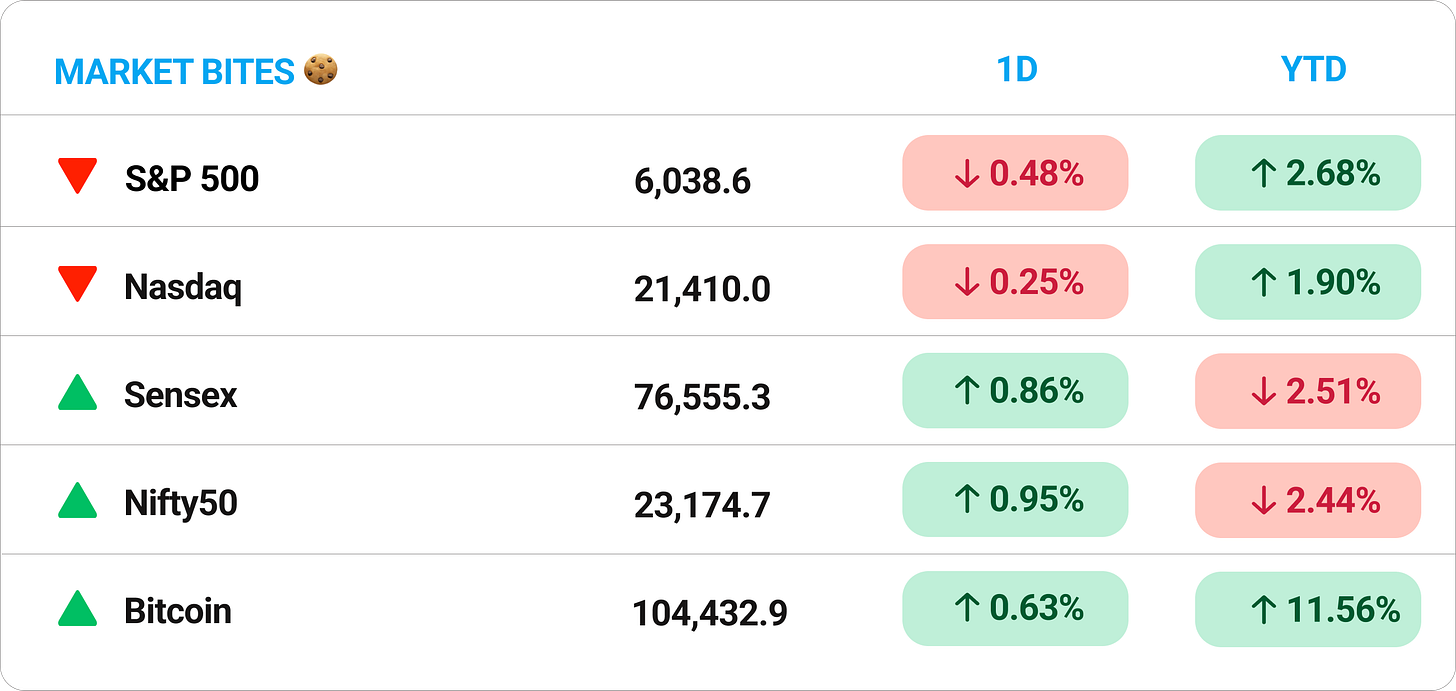

Markets had a solid day yesterday. Sensex climbed 0.86%, while the Nifty jumped 0.95% as investor sentiment got a boost.

📈 Across the pond, the Nasdaq rebounded, shaking off Monday’s DeepSeek-induced panic as investors bought the dip.

Tech earnings are also rolling through. Zuckerberg gets top marks on growth, profits, and AI capex. Meta’s operating margin is now at 50%. Talk about internet scale.

💡 Spotlight: Alibaba just escalated China’s AI war. The company unveiled Qwen 2.5, another open-source model that outperforms DeepSeek.

Let’s hit it!

1 Big Thing: Maruti’s growth hit a speed bump 🚗

Earnings season is here, and Maruti Suzuki’s numbers were solid—but not enough to impress investors.

Major stats: the automaker posted a 13% rise in net profit to ₹3,525 crore this quarter, with revenue climbing 16% to ₹38,492 crore. Both the numbers met investor expectations.

The snag: margins slipped slightly to 11.6% from 11.7%. Rising discounts, intensified competition from Tata Motors and Hyundai, and shifting consumer preferences are putting pressure on Maruti’s positioning.

The bigger worry: for the first time in 40 years, India’s best-selling car wasn’t a Maruti. Tata Motors’ Punch dethroned Wagon R and Swift to become the country’s top-selling car in 2024—a clear sign that consumer demand is shifting towards SUVs and spacier vehicles.

Why it matters: the entry-level car market, one that is ruthlessly competitive, is slowing, and Maruti is struggling to shake off its “budget brand” tag. Meanwhile, Tata and Hyundai are dominating the high-margin SUV and EV space, areas where Maruti has been slower to expand.

Zoom out: for now, the numbers set the stage for other auto giants reporting in the coming weeks.

2. Tito’s takes the party to Dalal Street 🤟

Tito’s Resorts and Hospitalities, the company behind Goa’s most iconic nightclubs, is planning an SME IPO, eyeing a valuation of ₹1,000 crore.

The deets: the IPO will likely be a fresh issue of equity shares, with Tito’s looking to dilute at least 30% of its equity.

What’s the business: founded in 1971, Tito’s has grown from a local nightclub to a full-blown hospitality brand, hosting everything from Miss India auditions to Sunburn afterparties.

The brand capitalizes on Goa’s 10 million+ annual tourist footfall, and its strong name recognition gives it a moat in the hospitality sector.

Some context: back in 2021, the D’Souza brothers sold 65% of Tito’s Resorts to external investors, but they still fully control Tito’s Spirits, their alcohol business in Goa.

Zoom out: 2025 is shaping up to be a big IPO year, with startups like Zepto, Ather Energy, PhysicsWallah, and BoAt also lining up for debuts.

3. India’s credit card boom accelerates 💳

Indians are swiping like never before.

The number of active credit cards has doubled to 108 million in the last five years, says an RBI report.

What’s driving it: credit cards are now the go-to for online shopping and big-ticket purchases, while debit cards have been relegated to ATM withdrawals and daily spending.

Digital payments like UPI have disrupted small transactions, leaving credit cards to dominate high-value purchases.

The numbers: the average transaction size jumped from $382 to $536, pushing total credit card debt to $3.5 trillion—a 19% YoY spike.

Private banks, thanks to their co-branded cards, flashy reward programs, and easy digital onboarding, now control 71% of the credit card market

The concern: while some are chasing points, others are just making ends meet. More and more consumers are seen leaning on credit cards to manage their finances—raising concerns about rising debt burdens.

4. Quick look at venture deals💰

Leap Finance, the education finance company, raised $65 million in a fresh round let by Apis Partners, with Owl, Jungle, Peak XV joining.

The round values Leap at $700–800 million. 80% of the funds are primary capital, while 20% came from secondary share sales.

Leap primarily runs a loan financing platform, along with services that help prospective students with test prep, application prep, and more.

While we’re on fundraises…

Atomicwork raised $25 million in a Series A round led by Khosla Ventures and Z47.

The company provides an enterprise automation platform, with a range of AI powered workflows to tackle repetitive tasks across functions like IT, HR, Finance, and more.

The fresh capital will fuel AI development and ramp up go-to-market expansion.

What else are we snackin’ 🍿

📉 Going down: Rupee logged the worst day in nearly 2 weeks closing at 86.5 against the dollar, down 0.2% on the day.

✨ Losing glamm: Key investors Accel, Bessemer, and Prosus have exited the Good Glamm Group’s board as the company battles a cash crunch and funding woes. The business was last valued at over a billion dollars.

🚨 Fed push: US Federal Reserve kept interest rates steady at its Jan meeting. But chair Powell claims inflation could be seen coming back, which could mean higher rates for much longer.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.