Google's biggest bet, Venture town hot, and Amazon's layoffs.

GM, momentum may be back in Indian stocks. Sensex and Nifty bounced back with an over 1% surge, marking their biggest single-day gain in almost two months.

Nothing fundamentally changed, other than the fact that investors understand things can’t stay low forever.

Meanwhile, U.S. markets are also recovering—since last Thursday, the S&P 500 is up 2.7%, as trade war jitters ease.

Data Spotlight: thanks to uncertainty around the world, Gold crossed ₹90,000 per 10 grams for the first time, and silver surged past ₹1 lakh/kg, gaining over 3% last week. Indian mum’s are the portfolio managers of the year, as far as our rankings go.

Let’s hit it.

1 Big Thing: Google’s $32 billion cybersecurity bet ☁️

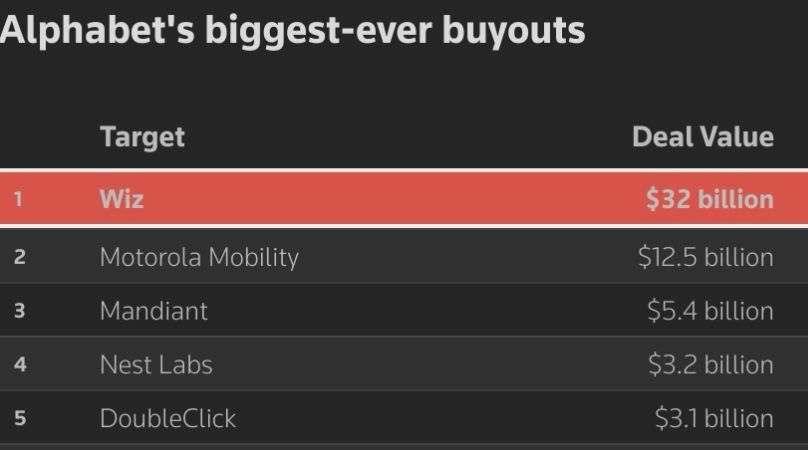

Google is buying Wiz, a five-year-old cybersecurity company, for an eye-popping $32 billion in cash. This would be Google's largest acquisition to date.

Wiz sells a cloud security platform that provides full visibility and security across code, development pipelines, and cloud systems—making it easier to secure applications built in the cloud.

In less than five years, they’ve grown to $700 million in annual recurring revenue and is expected to hit $1 billion next year.

The move: Google hopes to integrate Wiz into its thriving Google Cloud business, which generated nearly $48 billion in revenue last year and holds the No. 3 market share behind AWS and Microsoft Azure.

Worth noting: the Wiz acquisition complements Google’s 2022 purchase of cybersecurity firm Mandiant for over $5 billion. With AI playing a growing role in security applications, Google is positioning itself for a bigger slice of the cybersecurity market.

- The deal also includes $1 billion in retention bonuses to keep Wiz’s 1,700 employees on board.

Zoom out: With Donny back in office and FTC Chair Lina Khan out, big tech deals are making a comeback. Given the scale of this acquisition, the rest of the tech industry is sure to take notice—especially those eyeing exit opportunities in a market full of paper-money valuations.

Yes, but: Not everyone is celebrating. Google’s public market investors were less thrilled, arguing that the $32 billion could have been better spent—on dividends or share buybacks, for instance.

2. Busy day in India’s venture town 💰

Beauty and personal care brand Pilgrim has raised $23 million in a mix of primary and secondary funding rounds from existing and new investors, according to Entrackr.

The deets: Pilgrim operates an online cosmetics store, offering skincare, haircare, and more through its website, app, and major e-commerce platforms.

Its key differentiator? A focus on bringing global beauty trends to India, from French vinotherapy to Korean skincare secrets, while blending them with science-backed formulations.

The brand currently serves over a million customers monthly and is on track to hit a ₹1,000 crore revenue run rate by 2025.

Big theme: India’s beauty and personal care industry is projected to reach $17 billion by 2027, growing at 10% annually, driven by rising disposable incomes and a shift toward premium beauty products.

3. PhysicsWallah is going public 🫡

PhysicsWallah confidentially filed for an IPO, looking to raise up to $500 million, joining the likes of Tata Play, OYO, Swiggy, and Credila Financial Services to take the secretive route.

Confidential filings allow companies to keep financials and business data under wraps until they finalize the public offering.

The company could seek a valuation of over $5 billion, which again depends on how the market feels in a few months. PW was last valued at $3.7 billion, and remains on a decent financial footing.

- Revenue surged 160% YoY to ₹1,940 crore in FY24.

- But net loss widened to ₹1,131 crore.

The backstory: PW’s founder-led narrative is its biggest strength in convincing investors. Until 2014, Alakh Pandey was on a regular gig training teenagers for IIT-JEE in a popular coaching-center in India. That year, he kicked off a basic YouTube channel, explaining concepts and solving questions.

That became the foundation of a massive digital empire. Today, the company runs a mobile-app has 20M+ downloads, a 13M+ subscriber YouTube channel, and 60+ offline coaching centers across 30+ cities.

Zoom out: Edtech hasn’t had the smoothest ride in recent years—Byju’s is struggling, Unacademy pivoted hard, and Vedantu is laying low. PW’s IPO will be a key test of whether investors still believe in the sector.

More on IPOs,

Pine Labs, the Indian fintech firm, may go public in the second half of 2025 with a $1 billion offering. If successful, the listing would be India’s second-largest fintech public offering, following Paytm’s $2.5 billion debut in 2021.

4. Stocks we found interesting:🚀

1. Data Centers drive L&T stock

L&T will build three new data centers in India, investing up to ₹3,600 crore. The move is aimed to expand the company’s data center capacity in India fivefold by 2027 to 150MW.

The deets: primarily an engineering and construction services firm, L&T has been expanding into data center infrastructure as part of its digital and technology-driven growth strategy.

The new data centers are coming up in Bengaluru, Panvel, and Mahape. At present, the company operates data centres in Mumbai and Chennai, with a combined capacity of 32 MW. Stock popped 3% on the news.

2. PayTM will manage your money 📊

Paytm’s wholly-owned subsidiary, Paytm Money, received a Certificate of Registration as a Research Analyst by SEBI.

The deets: Paytm Money will be able to provide investment insights, research reports, and data-driven analysis to help users make informed decisions.

Why it matters: the approval comes as Paytm faces regulatory scrutiny. Earlier this month, the company had received a ₹611.1 crore show-cause notice from the ED over alleged violations of the Foreign Exchange Management Act, 1999 (FEMA).

Worth noting: firms including Zerodha, Groww & Upstox have also secured this certification.

As of 2024, there are 1,330 SEBI-registered research analysts in India. This marks a significant increase from 467 in March 2018, reflecting a 57% growth by March 2021.

5. Story in data: Beyond biryani 📊

Zomato has been quietly diversifying beyond food delivery. Quick commerce is definitely at the core, but so is a B2B business and an entertainment business.

What else are we snackin’ 🍿

🔌 Fast charging: BYD is rolling out next-gen fast charging with a battery that powers 400 km in just 5 minutes, hitting roads next month.

♟️LIC’s move: LIC is in talks to acquire a stake in a health insurance firm. Looking to expand their products in the sector.

📉 Shakeup: Amazon is cutting 14,000 managerial roles by early 2025, slashing its global management workforce by 13% to save $2.1–$3.6 billion annually.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.