Motherson acquires Marelli, Groww's IPO, and Volvo trims team.

🗓 Morning, folks!

Markets stayed in cruise mode on Monday with steady gains, but nothing flashy. Sensex and Nifty both rose over 0.5%, holding the green thanks to strong moves in auto and IT stocks. US markets were closed for Memorial Day.

Spotlight: auto shares were on the move on Monday, driving the Nifty Auto index over 1% higher and making it amongst top sectoral gainer of the day.

The boost came after US President Donald Trump delayed a proposed 50% tariff on European Union imports to July 9, following a call with EU Commission President Ursula von der Leyen. This rollback came as a breather for global auto supply chains, especially for EU-based automakers and their Indian partners.

Let’s hit it!

1 Big Thing: Motherson eyes a Japanese reboot 🚗

Indian auto parts giant Motherson is acquiring Japan’s Marelli from KKR by buying its debt at a steep discount.

The Deets: Motherson Group is one of India’s largest auto component suppliers, known for wiring harnesses, mirrors, and interior systems for global carmakers. Marelli is a major Japanese auto parts manufacturer, supplying lighting, electronics, and powertrains to global OEMs like Nissan and Stellantis.

This deal isn’t a straightforward buyout as Motherson will acquire Marelli’s debt at just 20 cents on the dollar.

Zoom Out: by acquiring Marelli, Motherson is upgrading its portfolio and strengthening its presence in high-tech, high-margin auto segments.

While we are on acquisitions,

Adani Group is leading the race to acquire a stake in Diamond Power Infrastructure Ltd (DPIL).

The deets: based in Ahmedabad, DPIL is an end-to-end power infra player, making cables, conductors, transmission towers, and even executing turnkey projects. It has a market cap of ~₹5,000 crore and posted ₹343 crore in revenue for FY25.

Zoom out: Adani is ramping up FY26 capex to ₹1.4–1.45 trillion (up from ₹1.26T last year) and doubling down on vendor consolidation. DPIL fits perfectly into Adani’s strategy of securing supply chains across its power and infra empire.

Why it matters: for DPIL, the deal could be a breakout moment, with a target to scale 30x to ₹10,000 crore in three years, a deep-pocketed partner like Adani unlocks both capital and contracts.

2. Groww gets IPO-ready, quietly 📈

Groww has confidentially filed for its IPO, marking its quiet step towards going public.

The deets: Groww, India’s largest online broking platform by active users, is targeting a valuation of $7–8 billion. The IPO could see 10–15% equity dilution, translating to a $700–920 million issue.

The move comes even as investor appetite across fintech is turning cautious.

In FY24, the company more than doubled its consolidated revenue to ₹3,145 crore, while profit rose 17% to ₹535 crore. For context, FY23 revenue stood at ₹1,435 crore.

Zoom out: India’s broking industry is under pressure. Stricter SEBI norms on margin trading, pledging, and disclosures are slowing retail expansion. Add tighter rules on ads and influencer promos, and the landscape is shifting fast.

Big theme: retail broking boomed post-COVID with Groww, Zerodha, and Upstox leading the charge. But with slowing growth and falling active users, focus is now on profitability. Groww’s IPO will test if these platforms can shift from hype to sustainable scale.

What next: a key trend across broking has been diversifying into full stack of financial and wealth management solutions. Groww has made its own moves, buying India Bulls’ AMC business, and more recently Fisdom’s wealth management business. Will markets bite?

3. RateGain profit jumps in Q4 🧳

Travel-tech giant RateGain wrapped up Q4 with stable growth, improved margins, and investor thumbs-up.

RateGain is a quiet but mighty player in the travel-tech space, offering SaaS solutions that help hotels, airlines, and OTAs improve bookings, pricing, and operations.

By the numbers

- Revenue: ₹260.6 crore, up 1.9% YoY (vs ₹255.8 crore)

- Profit after tax: ₹54.8 crore, up 9.6% YoY (vs ₹50 crore)

Why it matters: global travel hasn’t fully bounced back—post-COVID demand remains uneven. But RateGain kept things tight with lean ops and sharp execution. A record EBITDA margin of 23.2% shows it’s not just surviving, it’s scaling smart.

Now, it’s ramping up go-to-market efforts and expanding globally. With margins strong and product-market fit locked in, RateGain looks ready for a longer runway.

4. Stocks that kept us interested 🚀

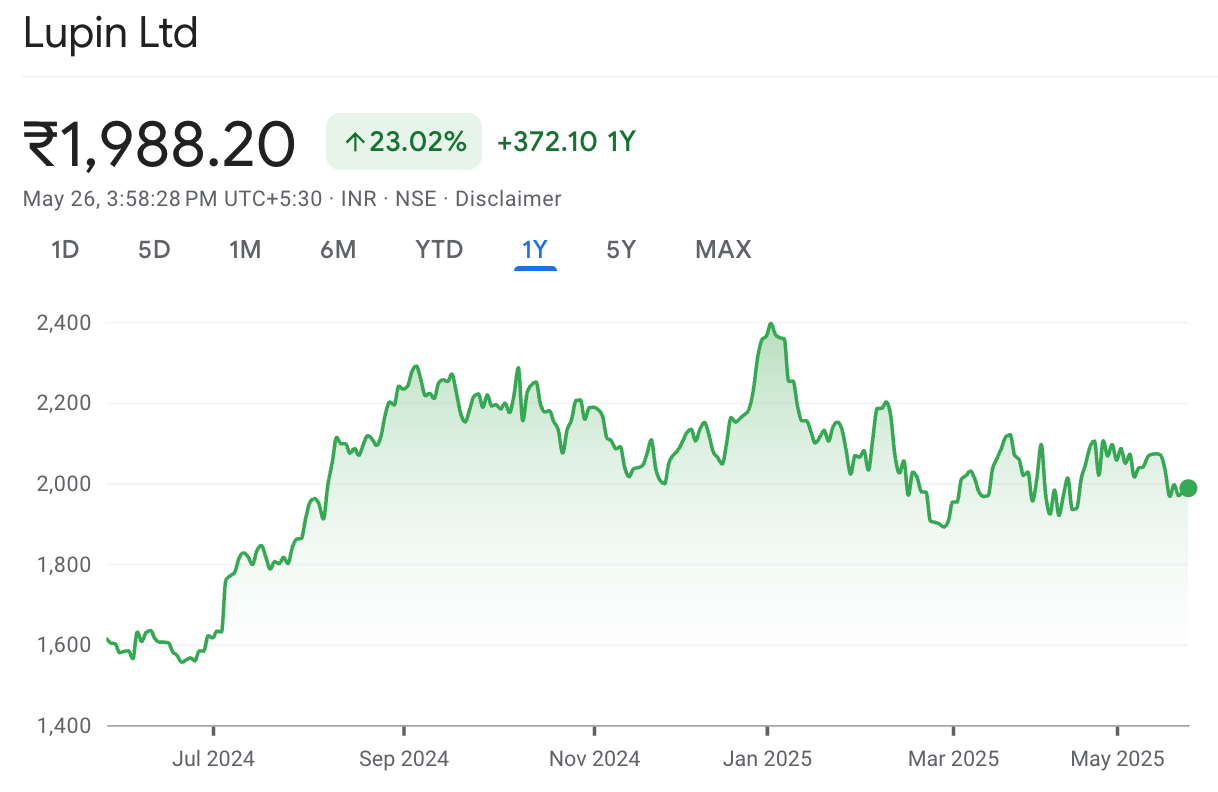

1. Lupin’s Latin America win 👁️

Lupin signed a licensing and supply deal with SteinCares for its eye disease drug biosimilar Ranibizumab in Latin America.

The deets: Lupin is a global Indian pharma player known for generics, biosimilars, and specialty drugs. SteinCares is a Latin American healthcare company focused on biosimilars and affordable medicines.

- Ranibizumab is a biosimilar used to treat vision-threatening retinal disorders like age-related macular degeneration and diabetic macular edema.

Under the deal, Lupin will handle manufacturing, while SteinCares will lead regulatory filings and commercialisation.

Why it matters: retinal diseases like macular degeneration and diabetic macular edema are major causes of vision loss. A cost-effective biosimilar can boost treatment access and affordability, especially in Latin America, where need is high and options are limited.

5. RBI’s dividend hits all-time high 💰

The Reserve Bank of India is handing the government a record ₹2.69 trillion dividend for FY25, up 27% from last year’s ₹2.1 trillion and more than triple FY23’s ₹87,416 crore.

The Government of India owns the RBI completely. Like any company that distributes profits to its shareholders, RBI pays a dividend to its only shareholder — the government.

Know your stuff? ☕

We’re always looking to add real context to our stories, and sometimes the best insights come from people on the ground.

If you’re an operator, founder, analyst, or just someone who’s really into a specific industry—we’d love to hear from you.

If you’ve got something to say (or just want to jam), mention it in the form or drop us a line at team@filtercoffee.co

We’ll reach out when we’re covering your beat.

Hit us up 📩

What else are we snackin’ 🍿

🏛️ JSW relief: JSW Steel bounced back over 2% after the Supreme Court ordered status quo in the ongoing Bhushan Steel ownership case.

🚘 Volvo trims: Volvo Cars will slash 3,000 mostly white-collar jobs, about 15% of its global office staff, as it battles high costs, slowing EV demand, and tariff uncertainty.

📊 NSE’s reset: The National Stock Exchange is reportedly offering ₹1,000 crore to settle a long-pending case with SEBI.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.