Tariffs 2.0, Penny drops, and Mega deals.

🗓 Morning, folks!

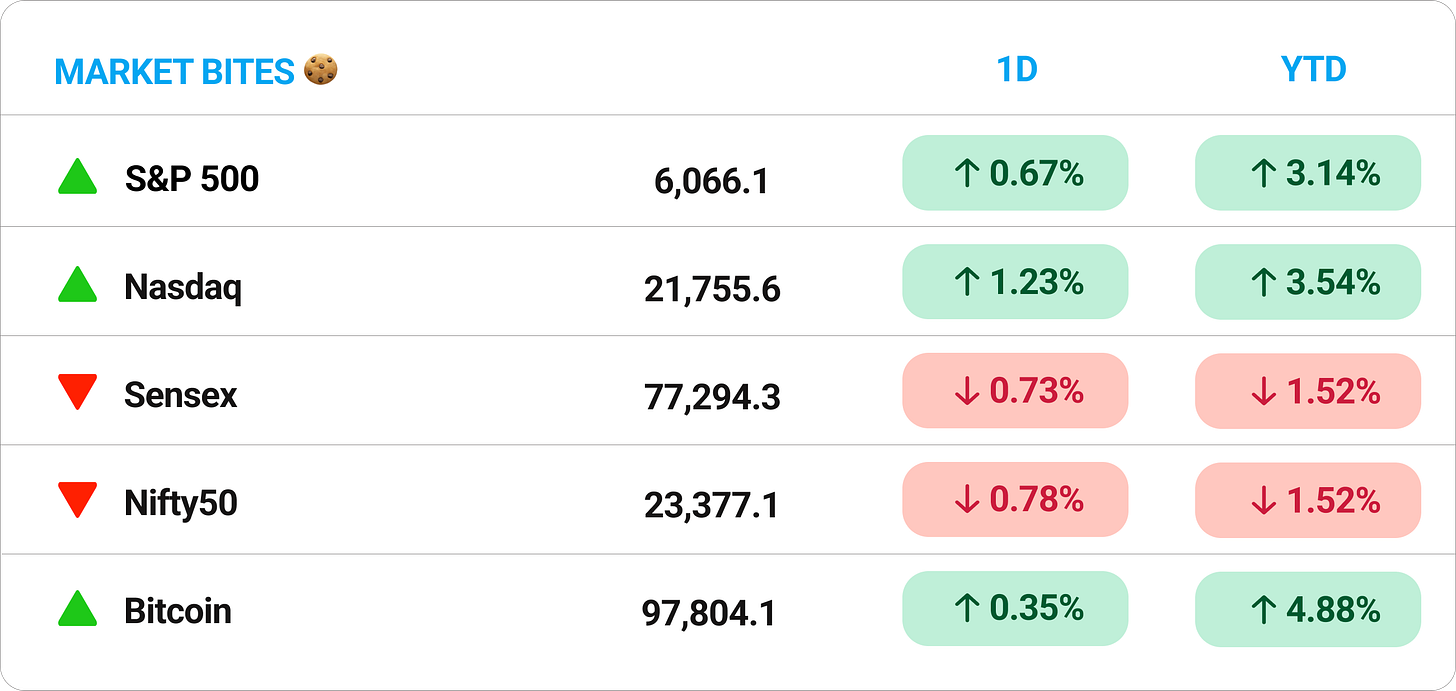

📉 The markets simply cannot catch a break, with the Sensex down over 0.70% and Nifty down over 0.76% yesterday. Trump’s fresh round of tariffs on steel and aluminium sent Nifty Metal down 2.64%, fuelling investor jitters.

💡 Spotlight: Apple’s India play is paying off. The tech giant exported $11.4 billion worth of iPhones in just 10 months of FY25, hitting a new milestone. January alone saw $2.2 billion worth of exports, powered by the iPhone 16 launch.

The two winners of this shift have been Foxconn and Tata Electronics. And, no Tata Electronics isn’t public yet, but that could change soon.

Let’s hit it.

1 Big Thing: Nykaa delivers on a high 💰

Earnings season continues to bring some positives. Nykaa posted a strong Q3, fueled by booming beauty sales.

By the numbers: for the quarter, Nykaa made ₹2,267 crore in revenue, up 27% YoY. Net profit jumped 60% to ₹26 crore. Margins expanded to 6.2% from 5.5% YoY.

The beauty and personal care segment led the charge, growing 27% YoY to ₹2,060 crore, driven by the blockbuster Pink Friday Sale in November.

Fashion, however, remained sluggish at 21% growth, trailing expectations. The segment continues to struggle with weaker demand in online fashion, a trend that’s impacted the entire industry.

Nykaa is also pushing hard into quick commerce.

Over 70% of its beauty orders are now delivered within a day in 110 cities, with its pilots in Mumbai, Delhi, and Bengaluru exceeding expectations.

Zoom out: India’s e-commerce market is evolving fast. Nykaa’s fashion ambitions face stiff competition from Myntra and Ajio, while new players like Reliance-backed Shein add more pressure.

Meanwhile the quick commerce angle is capable of delivering some real growth real fast.

Despite all that, the numbers weren’t good enough to entice markets. Stock dropped over 1.8%.

While we are on earnings…

Logistics services provider Delhivery posted a mixed Q3, with profits soaring but margins slipping.

Net profit more than doubled, rising 113% YoY to ₹25 crore, while revenue climbed 8.4% to ₹2,378 crore.

While that may seem good on face value, 8% growth is actually pretty weak for such a richly valued growth company. Moreover, margins slipped from 5% last year to 4.3% this year. No no with the markets!

Stock was hammered 5% on Monday and is down 23.8% in the last six months.

2. Major deals in focus 📶

1. Venturi Partners is pumping $25 million into JQR (Just Quick Run), a fast-growing player in India’s budget sneaker market.

The deets: founded in 2014, JQR specializes in affordable sneakers, tapping into India’s $12 billion mid- and economy-priced footwear segment.

With Venturi’s backing, JQR plans to scale both online and offline, expanding its presence beyond Gujarat and into metro cities where demand for budget-friendly, quality sneakers is rising.

Big picture: India’s footwear industry is one of the fastest-growing in the world, with government incentives and changing consumer trends boosting homegrown brands.

2. India and the US are closing in on two major defense deals ahead of PM Modi’s Washington visit.

The deets: India, the world’s biggest arms importer, has historically leaned on Russia for military equipment. But with growing US ties, that’s changing.

The Stryker Combat Vehicle Deal: India is negotiating to purchase and later co-produce General Dynamics’ Stryker combat vehicles—8-wheeled armored personnel carriers used by the US Army. This deal could be a crucial step in modernizing India’s military fleet.

The GE-414 Fighter Jet Engine Deal: India and the US are also finalizing a $1 billion deal to co-produce GE-414 fighter jet engines for India’s Tejas Mk2 combat aircraft, transferring critical technology and boosting India’s Make in India defense program.

Not to forget, the mandate is also to appease The Donald, as we negotiate a potential trade deal and avoid the tariff nonsense.

3. Big daily mover 🚀

Rail Vikas Nigam Ltd (RVNL) bagged a ₹335.4 crore contract from South Western Railway to install Kavach, across 790 route km in Hubballi and Mysuru divisions.

Kavach is India’s homegrown safety tech designed to prevent train collisions, and RVNL has been stacking up wins in this space.

This latest order comes just days after securing a ₹210 crore contract from South Eastern Railway and a ₹404 crore deal from East Coast Railway.

The news didn’t do much to move RVNL’s stock, which continues to remain under pressure from the broader market climate.

4. Trump is back, and so are the tariffs 🚨

Donald Trump is back on the tariff train, this time imposing a fresh 25% levy on all steel and aluminum imports.

Markets aren’t too thrilled. Steel and aluminum are critical for industries like construction, automobiles, and energy.

Oil drillers and wind developers, which rely on specialty grades not produced in the U.S., could be hit the hardest. If supply chains get disrupted, expect price spikes across sectors, from cars to canned goods.

The reasoning: Trump wants to boost domestic production and reduce reliance on foreign metals. U.S. steel and aluminum manufacturers stand to gain, while global exporters take a hit.

FYI, the US imports roughly 25% of all its steel.

Canada and Mexico, the top suppliers of these metals to the U.S., are still in the dark on whether they’ll be spared. Last time, they dodged tariffs by offering border security concessions.

5. Chart of the day 📈

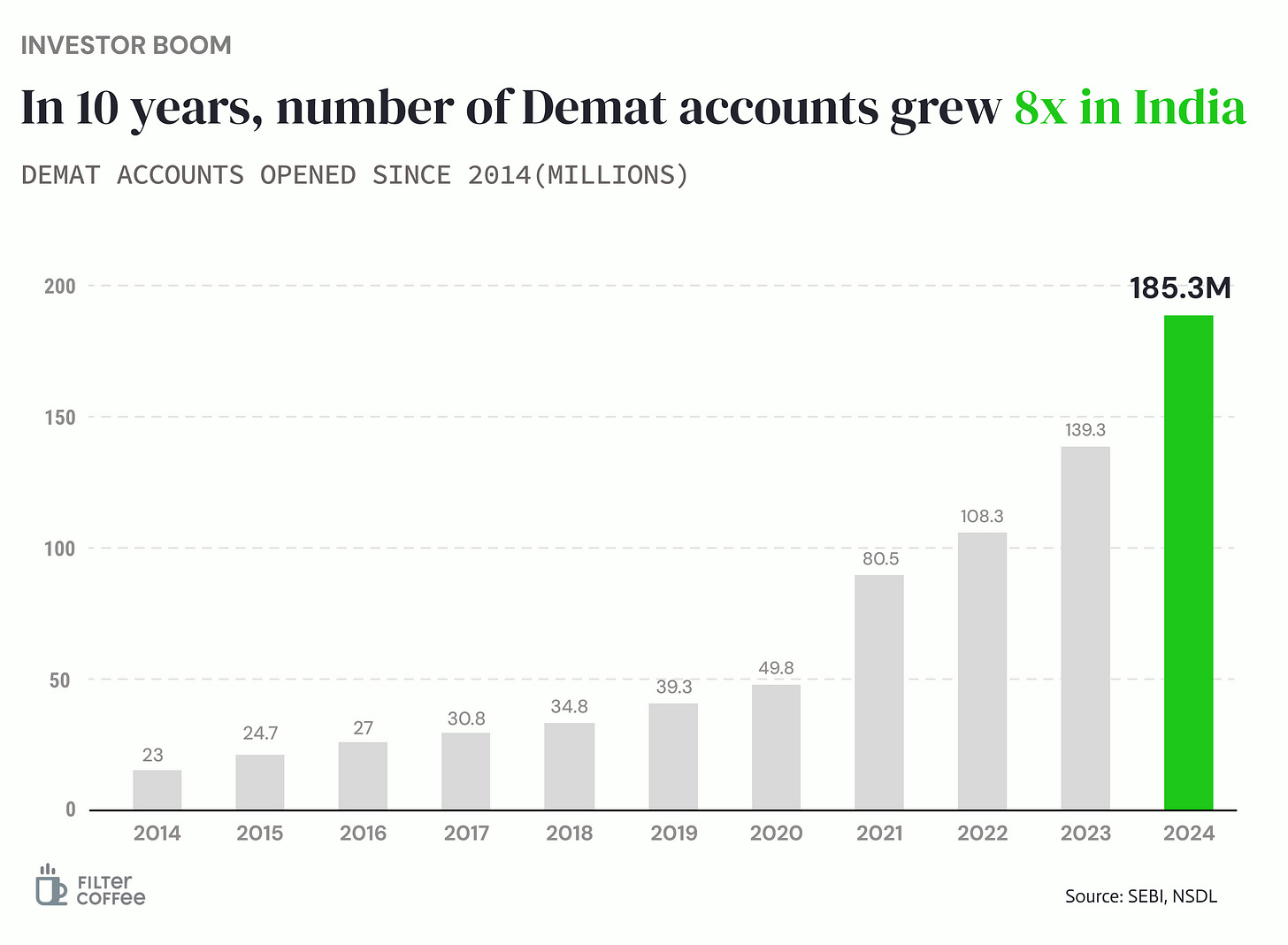

Demat accounts in India have grown 8x from just 23 million in 2014 to an impressive 185.3 million in 2024.

This growth is fueled by increasing retail investor participation, fintech adoption, and a shift toward equity investments, showcasing India’s booming financial inclusion and investment appetite.

What else are we snackin’ 🍿

🚫 Penny drops: Trump orders US Treasury to stop minting pennies, calling it a cost-cutting move.

🔥 Quick bites: Zepto Café is now clocking 75,000+ daily orders since launching in December.

📉 Meltdown: Investors lost ₹7.68 lakh crore in four days as Sensex slid 1.6%, hit by foreign outflows and tariff jitters.

💊 Green light: Natco Pharma secured final USFDA approval for Bosentan tablets, used to treat high blood pressure in the lungs.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.